Sustainability-Linked Loans: A primer for CFOs

Sustainability-Linked Loans (SLLs) allow CFOs flexibility around fund deployments, provide liquidity, and further opportunities to diversify the lender base while ensuring a good alignment of interests among borrowers and lenders about ESG. Here's a basic round-up of the financial tool

Sustainability-Linked Loans (“SLL”) have now emerged as one of the important types of sustainable financings

Image: Shutterstock

Sustainability-Linked Loans (“SLL”) have now emerged as one of the important types of sustainable financings

Image: Shutterstock

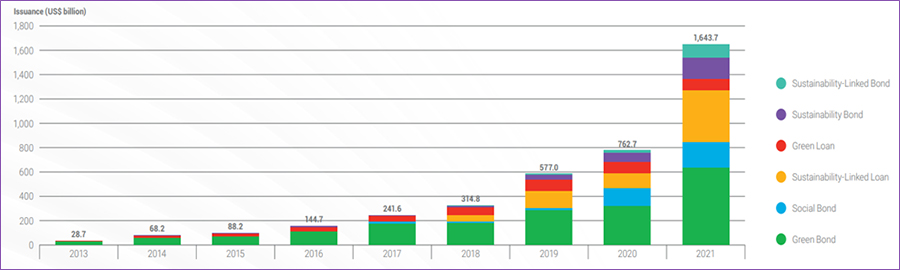

The global sustainable debt issuance set a record of surpassing $1.6 trillion in 2021 and exceeded $700 billion during the first half of 2022. Corporations are leveraging sustainability-linked finance instruments to further their Environmental, Social, and Governance (ESG) agenda, reduce the cost of borrowing, and diversify the lender base.

Sustainability-Linked Loans (“SLL”) have now emerged as one of the important types of sustainable financings. Despite a mere 4-year track record, SLLs have shown the strongest growth among various sustainable debt issuances. Starting with $49 billion in 2018, SLLs have crossed $350 billion in the first half of 2021—with 614 percent growth (Figure 1). So, it has now become imperative that all CFOs and Treasurers understand SLLs. Figure 1: Annual Sustainable Finance Growth (USD$ billion), 2013-2021

Figure 1: Annual Sustainable Finance Growth (USD$ billion), 2013-2021

Source: BloombergNEF, Bloomberg L. P.

History of SLLs

Formerly known as Positive-Incentive Loans, SLLs are loan products that incentivise borrowers to achieve pre-defined Sustainability Performance Targets (SPTs) related to environmental, social, and/or governance aspects. The targets measure improvements in a borrower’s sustainability performance and include pre-defined Key Performance Indicators (KPIs), external ratings, and/or equivalent metrics among others. If a company achieves its pre-defined SPTs, it benefits from a reduced interest rate, and a failure to do so leads to higher rates. For instance, JSW recently raised ₹400 crore from MUFG Bank India as SLL. According to the reports, JSW plans to deploy the funds as capital expenditure to achieve its annual capacity target of 25 million tonnes by FY25.SLLs are based on Sustainability Linked Loan Principles that have been issued by the Loan Market Association, the Asia Pacific Loan Market Association, and the Loan Syndications and Trading Association.

Source: SPJIMR

Flexibility

Unlike Green Loans, SLLs give a lot of flexibility to borrowers. In Green Loans, the proceeds must be used for green-focused projects or investments. However, SLLs are often structured as revolving credit facilities for general corporate purposes and don’t require details of the proceeds when borrowing. The absence of any pre-defined eligible project gives a lot of flexibility to the CFOs in fundraising and fund deployment. This is one of the key reasons for the rapid growth of SLLs compared to Green Loans.Also read: Financial inclusion: How the India Mortgage Guarantee Corporation ensures low-risk mortgage loans for low credit score individuals

Liquidity and opportunity to diversify the lender base

In addition to flexibility, liquidity is another reason for CFOs to embrace SLLs. A senior banker, who has been working in the Indian loan market for over 25 years, attributed the rapid growth in sustainability-linked financing to a combination of factors such as better liquidity, international lenders’ commitment to Net Zero targets, and ease of the use of proceeds. For some borrowers, SLLs can also be an opportunity to onboard new lenders and diversify their lender base. Further, the abundance of liquidity in many cases has also resulted in SLLs being priced more competitively. In addition, there is also a potential to reduce the cost of borrowing as the margin on the loan is linked to achieving pre-defined KPIs. Several SLLs adopt stepped pricing, allowing borrowers multi-level pricing benefits as they achieve one target after the other. Borrowers typically need to achieve a base target and then exceed this target by certain pre-agreed levels for further improvement in pricing.Conversely, lenders receive higher compensation in exchange for an increased (credit or operational) risk stemming from poor sustainability performance. To this end, credit rating agencies are exhibiting signs of a much more standardised integration of ESG risk assessment into the credit ratings, which would ultimately affect security and loan pricing. Irrespectively, in the backdrop of excessive liquidity, a CFO can reduce the cost of borrowing by focusing on SLLs.

So, while flexibility and liquidity are beneficial to the borrowers, there are also certain nuances about SLLs that a CFO must keep in mind. These are related to the lender’s expectations from the borrowers.

Reporting and verification requirements

Whilst SLL gives more flexibility to CFOs, it is important that SLLs still drive a positive impact on the ESG agenda. So, lenders are keen to determine compliance with KPIs and SPTs. But the credit policies and environmental risk assessments associated with SLLs are still under development. UN’s Global Compact CFO Taskforce intends to engage CFOs to establish universal standards for setting, measuring, and reporting sustainability targets. However, in the interim, till universal reporting standards are developed, lenders depend on annual reporting and external verification of the borrower’s performance to determine whether the KPIs and STPs have been achieved.According to industry experts, SLL lenders typically expect borrowers to meet the following requirements:

- To develop a sustainability framework to conduct annual verification of agreed KPIs/SPTs, preferably by second-party opinion (SPO) providers, and

- To establish ESG rating as an additional benchmark for meeting sustainability targets

So, CFOS must have a good understanding of the reporting requirements before embarking on SLL issuance.

KPIs, the pivot from a lender’s perspective

Lenders have a set of KPIs for themselves, related to the share of impact investing within their lending books. According to research by S&P Global Ratings, the need for enhancing the share of impact financing within lending books has been one of the key drivers for growth in sustainability-linked debt among banks.The Capital Requirements Regulation set by the European Parliament and the Council of the European Union establishes a framework of regulatory capital, liquidity, and leverage applicable to European credit institutions and investment firms. The framework offers preferential treatment of financings to projects that meet certain environmental and sustainability objectives. Long-term asset owners, like pension funds, have shown that sound, sustainable management improves long-term risk-adjusted returns. These improvements show up in letters or numbers, like credit ratings and capital adequacy ratios, and are reflected in the costs of borrowing and the prices of securities.

So corporate treasurers and CFOs need to appreciate lenders’ requirements for KPIs that can be monitored and improvements in KPIs that constitute a significant positive sustainability impact. Alternatively, borrowers can set targets beyond ‘business-as-usual’ or goals that exhibit a higher annual change in comparison with previous performance or outperform industry peers or align and outperform international standards. Recently, Mercedes-Benz converted an €11 billion revolving credit facility into a sustainability-linked loan, with KPIs chosen through a materiality analysis in line with the company’s sustainability strategy. So materiality of KPIs is the cornerstone of robust sustainability-linked finance.

Also read: How GetVantage is democratising access to working capital for underserved businesses

Concerns around SLLs

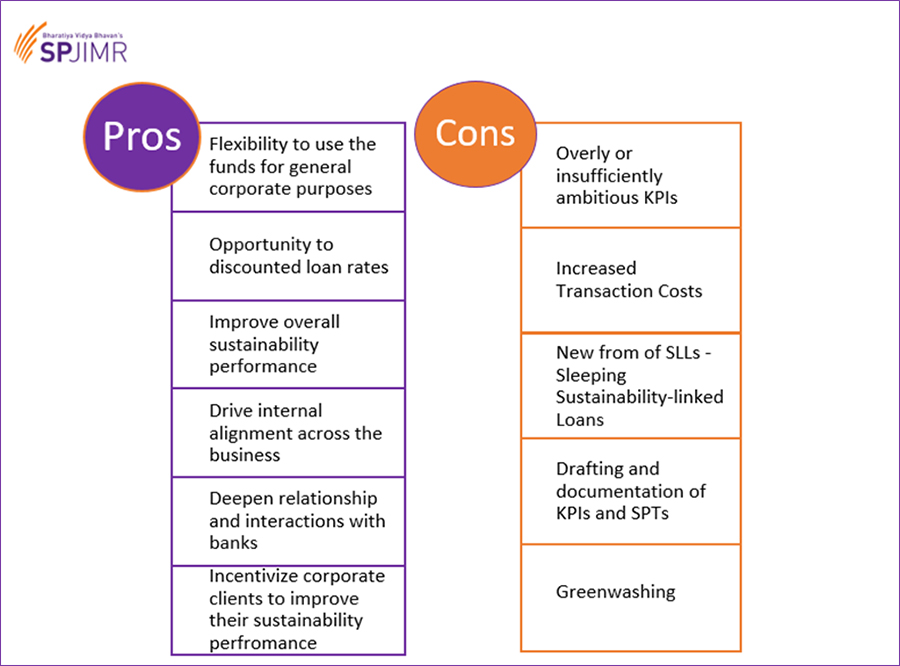

Although SLLs look attractive, they are an emerging product with a specific set of challenges and risks. One of the concerns is increased transaction costs associated with finalising a suitable framework for achieving and monitoring KPIs. This is generally due to the underdeveloped market practice for SLLs. In some nations, such as Singapore, a new Green and Sustainability-Linked Loans Grant Scheme has been established to provide economic relief for borrowers and financiers. This can increase the accessibility of SLLs, particularly for small and medium-sized enterprises (SMEs). Similar policies can be implemented in other nations to increase accessibility to SLLs, particularly SMEs.Another concern is borrowers mislabelling their loans as SLLs and making unsubstantiated claims of sustainability. Such allegations can be damaging for both the companies as well as lenders. Adding fuel to this concern, a new segment of the SLLs is emerging titled ‘Sleeping Sustainability-Linked Loans’. These SLLs enable a company to issue a loan on the condition of stating the sustainability performance targets later. While the Loan Market Association is working on guidance to regulate Sleeping SLLs, these transactions are sending out worrisome signals.

Benefits and Challenges

Source: SPJIMR

Way Forward

SLLs have emerged as an attractive option that ensures a good alignment of interests among borrowers and lenders about ESG. SLLs also bridge the gap between traditional and sustainable financings as businesses begin their journey to net zero. So, the SLL market looks poised to grow further, and all CFOs must have a good awareness of SLLs.Manoj Mohan, Executive Director, Centre for Financial Studies (CFS) at Bhavan's SPJIMR

Mansi Gupta, Research Associate, Centre for Financial Studies (CFS) at Bhavan's SPJIMR

[This article has been reproduced with permission from SP Jain Institute of Management & Research, Mumbai. Views expressed by authors are personal.]