Banking On Innovative Ideas

The book inspires bankers to think differently

“He profits most who serves best” – Arthur F. Sheldon

I’ve had the opportunity to contribute to and be actively involved in a customer intensive business–that of retail banking. It’s been an exhilarating journey and every time I interact with bankers, I see the same sense of eagerness and passion in them to transform the banking landscape and do things differently.

A book that appropriately highlights this inevitability of enhanced ‘connect’ between banks and customers is Banking 2.0 by Bret King. Its simple, but engaging content, emphasises the innovative use of technology to create healthier customer relationships. The book inspires bankers to think differently about their trade and urges them to develop unconventional ways of striking ‘the’ chord with customers. In his book, King examines trends, innovations and technologies that are likely to have the most significant impact on financial services and consumers over the next decade and gives his own unique take on them. From traditional media and advertising to social networking and mobile technologies, he looks at the forces shaping the way banks and their customers interact.

Another important takeaway from this book is the crucial need to continuously ‘reinvent the wheel’. While this mindset is a prerequisite for most leaders, I believe, if every employee in an organisation has this attitude, corporations will certainly innovate and be successful. In the current business and economic environment, it’s even more important to analyse and adapt strategies that allow us to get closer to our customers. For a banking technology company like ours, helping our customers understand the pulse of their customers’ needs and supporting them in this dynamically evolving scenario remains a top priority.

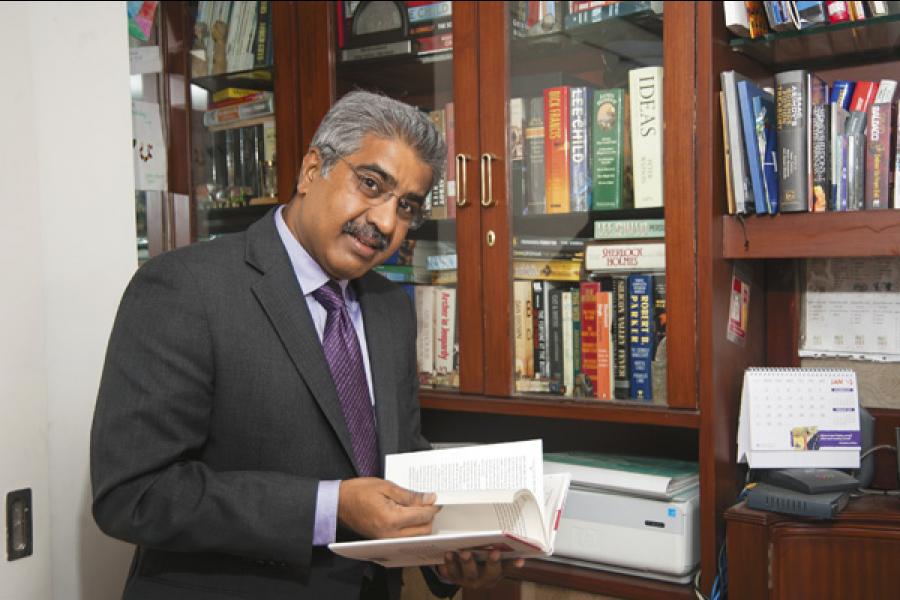

Chet Kamat is MD & CEO, Oracle Financial Services Software

(co-ordinated by Rohin Dharmakumar)

(This story appears in the 03 February, 2012 issue of Forbes India. To visit our Archives, click here.)