Indian Banks: Healthy, But Precarious

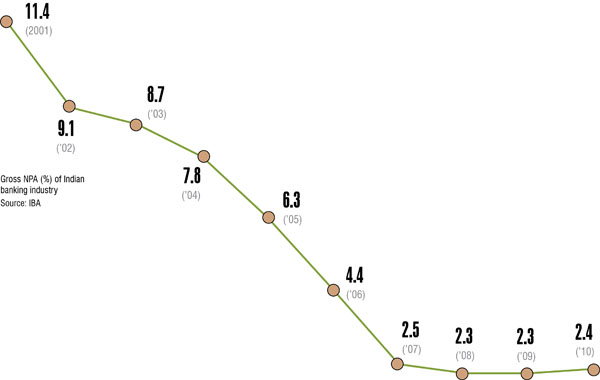

Indian banks have brought bad loans down to 2.4 percent over 10 years, but now they need to be careful

The past three months have been tough for Indian banking. High interest rates and threats of a global recession have taken their toll on bank stocks. The NSE banking index fell 15 percent compared with the Nifty’s 11 percent slide in the past three months. Indian banks, ironically, have never been in a better state of health in the past 10 years.

A recent study by Boston Consulting Group (BCG) found that bad loans fell from a peak of 11.4 percent in 2001 to just 2.4 percent in 2010, showing the efficiency of management of capital. In fact, Indian banks have been performing better in controlling defaults with only 0.6 percent of loans handed out last year turning sticky, compared to 1 percent in the US and China. Indian banks also have a cost-to-income ratio of 47 percent, which is lower than Germany, France and the US.

But now stress signals are showing up. The Reserve Bank of India expects non-performing assets (NPA) to inch up to 2.9 percent during 2011. IDFC Securities, a broking firm, recently said at least 17 percent of loans are stressed and some could go bad. Total bank credit to the industrial sector stands at about Rs. 17,60,600 crore.

“Credit to power and infrastructure sectors has grown 40 percent in the past four years and the proportion of the same has gone up to 14 percent in terms of total credit offtake, which has created additional risks to the banking segment,” says Ajay Parmar, head of institutional research at Emkay Global.

State-owned banks have a higher allocation to small industries, which could get hurt early if there is an industrial slowdown. Additionally, the central bank’s battle with persistent inflation is raising the cost of money, pressuring net interest margins that are expected to continue to narrow for at least another two years.

But no one is pressing the panic button yet because there is no dearth of liquidity in the system. Says Rajeev Thakkar, CEO, Parag Parikh Financial Advisory Services, “If margins are high then NPAs are not a cause for concern... There is a difficulty in the system but we are certainly not into recessionary territory.”

(This story appears in the 07 October, 2011 issue of Forbes India. To visit our Archives, click here.)

-

Banksindia

BanksindiaNow a days Indian banks are healthy and safe...All Banks details available in our website http://banksindia.in

on Oct 28, 2011 -

Danendra Jain

Danendra JainPlease refer website of Reserve bank of India http://www.rbi.org.in/scripts/PublicationsView.aspx?id=12017 http://www.rbi.org.in/scripts/PublicationsView.aspx?id=13134 http://www.rbi.org.in/scripts/PublicationsView.aspx?id=13118

on Oct 10, 2011 -

Danendra Jain

Danendra JainGross NPA percentage of banking industry was never 11% or 9% or 7% as represented in above graph. Entire graph is wrongly depicted. Correct information have to be and should be submitted.

on Oct 10, 2011-

Pravin Palande

Pravin PalandeDear Danendra, We cross checked. Our numbers are from IBA given to us by Boston Consulting Group. Can you please let us know what is your source of information?

on Oct 10, 2011

-

-

Danendra Jain

Danendra JainMy View on this article published on website of moneycontrol.com I fully disagree with the conclusion arrived at by Forbes India. It is not true that due to tight management banks has been able to control NPA during last one decade and absolutely false to say that banks have got success in bringing it down from 11% in 2001 to 2.8% in 2011. Bitter truth is that banks have fraudulently and in nexus with RBI and auditors have concealed all bad assets and concealed NPA during last ten years in the name of reformation. Secondly they have reduced their exposure in small segment and increased their focus and their exposure on bulk lending. This is why 70 to 80 to their total disbursement during last ten years are for big corporate and government companies which help in reducing Gross NPA percentage. I peeped into loan portfolio of one of government banks and found that loan outstanding in the name of top 500 borrowers is 50000 crores out of total loan portfolio of Rs.150000/ crores of the bank. It means loan shown to be disbursed to priority sector is inflated by including bulk loan and obviously the bank is falsely claiming that the bank is fulfilling RBI target fixed for various segments in priority sector.RBI is willfully silent spectator of all frauds committed by chief of various banks. Obviously banks have controlled NPA ratio firstly by concealing bad assets and secondly by increasing bulk lending and neglecting small farmers, small traders and small manufacturers for which banks were nationalized in 1969. If list of newly generated NPA of any bank is properly analysed it will precipitate that account was in fact NPA long ago but banks willfully concealed the same and booked interest as income against RBI's prudential norms for income recognition. In this way banks not only inflated income but also saved provision to a great extent. Now when RBI has forced to declare NPA as per systems top bankers are weeping and searching lame excuses of global recession or bad weather or inflation or high interest rate.

on Oct 10, 2011