Why Indian Brokerages are Looking Elsewhere

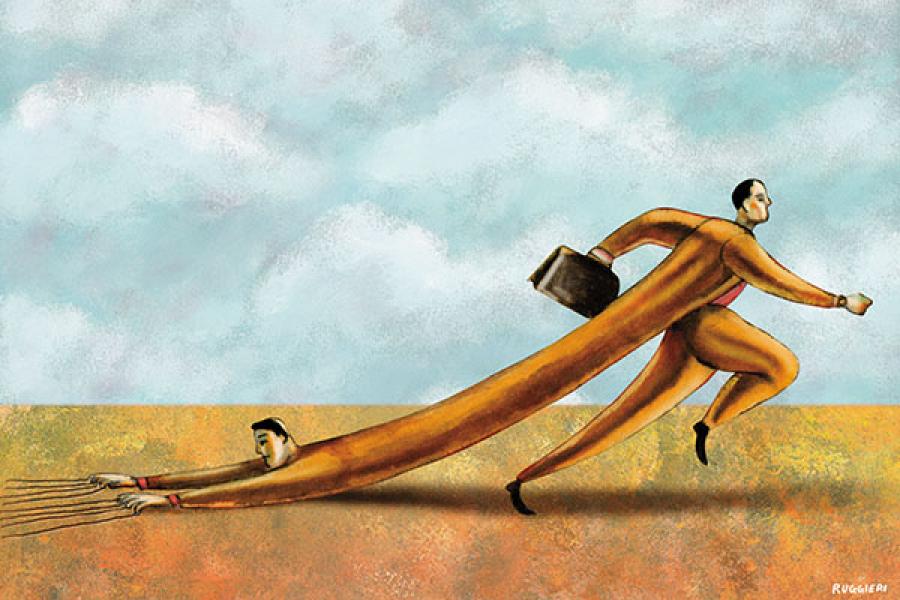

Stiff competition from foreign players and a bad market is making Indian broking firms take on other financial activities

Inside every fat Indian broking firm there is a thin NBFC waiting to come out.

A lacklustre market, changing technology and competition from foreigners is forcing most Indian broking firms to look for other revenue sources. Apart from Motilal Oswal, there is not a single listed broking company where the bulk of revenue comes from pure broking. There are six listed broking firms, of which three (Edelweiss, IIFL and Indiabulls) want to be known as non-banking financial companies (NBFCs), where around 20 percent of the business comes from broking activities and the rest from lending, private equity or other fee-based businesses like investment banking.

Consider the revenue composition of major Indian brokerages. In FY2012, India Infoline had around 29 percent of its revenues from broking (the rest from lending and other fee-based activities). Results of the last quarter of FY2012 show broking revenue dipped to 20 percent. At Edelweiss Financials, broking revenues now account for 20 percent of the overall income; in 2007, broking and commissions accounted for 60 percent of the total revenue.

Indian broking firms have little choice. Global behemoths from the US have taken away the institutional business. The foreign players—CLSA, Morgan Stanley, Merrill Lynch, JP Morgan and Credit Suisse—have around 70 percent of the market share, and have continued to extend their dominance even though the state of the Indian stock markets haven’t been very good. Yields from broking or commissions charged to clients are down to 10 basis points from 17 over the past three years. Yet, foreign brokers have managed to hold their own because of their access to technology and global relationships. Things like direct market access allows institutional investors to go to the exchange directly. But a broker is still needed to provide cover for the counter-party risk and foreign brokers are able to provide this. Also, FIIs or foreign investors, which drive much of the Indian market, feel more comfortable dealing with international partners.

Yields from broking may fall further, to even 5 basis points (0.05 percent), as competition intensifies. “As a strategic move, we decided to enter other businesses, like credit, AMC and life insurance, as part of becoming a diversified financial services company,” says Vikas Khemani, president and head of wholesale capital markets at Edelweiss Financials.

Motilal Oswal is the only exception. Around 70 percent of its revenues come from core broking, but it has become very active in building a suite of products in its mutual fund and private equity business, and is focussed on wealth management in the near future. “We will stick to our core business and concentrate on fee- or transaction-based businesses, and that is the area we prefer to grow rather than get into fund-based activities,” says Motilal Oswal, managing director, Motilal Oswal Financial Services.

In the next few years, even if the Indian market improves, the market share of foreign players will increase to 80 percent because they have technology and clients on their side. Hopefully, the new sources of revenues will become big enough for Indian brokers to stay in the game.

(This story appears in the 17 May, 2013 issue of Forbes India. To visit our Archives, click here.)

-

Discount Brokerage India-tradesmart

Discount Brokerage India-tradesmartMost of participants are small investor in India, it's real truth. And They Looking elsewhere for a reliable Broker always...

on Feb 12, 2014 -

Narayanan

NarayananThe major concern of the brokerage industry in India is the low participation of Retail/small investors. Many small investors have burnt their fingers in the past. May be, voluntarily educating public will help in bringing back the crowd to the market there-by increasing the revenue for the brokerage industry.

on May 19, 2013