After 20 rejections, here's how Mintifi raised $120 million in the funding winter

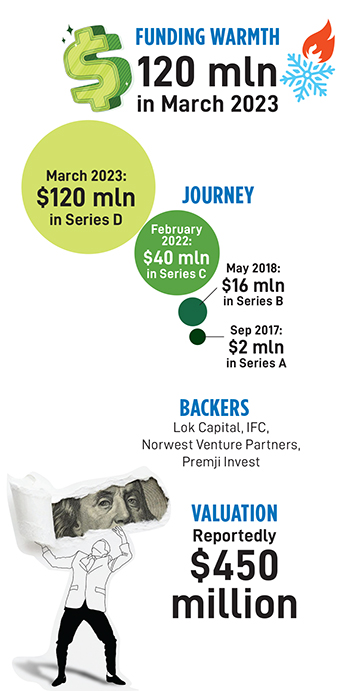

Back in 2017, Anup Agarwal wanted to raise $2 million for funding his maiden venture Mintifi. He got rejected by 20 funds. In 2023, he raised $120 million on the back of a profitable and thriving fintech venture

Anup Agarwal, Co-founder and CEO, Mintifi

Image: Mexy Xavier

Anup Agarwal, Co-founder and CEO, Mintifi

Image: Mexy Xavier

Mumbai, 2017. The investment banker was bemused. “How is it possible,” wondered Anup Agarwal, who had spent eight years at Jefferies, and five years at Kotak Investment Banking. Now, when he was taking the entrepreneurial plunge, the greenhorn met with a spate of stunning rejections. “Are they serious,” the chartered accountant pondered as he tried to make some sense of the “utter nonsense” that was happening around him. “Guys, what I am asking for is just $2 million,” the rookie founder pleaded his case and flaunted his enviable background where he helped umpteen founders raise millions of venture and private equity dollar, stitched innumerable mergers and acquisition deals, and closed countless high-ticket transactions.

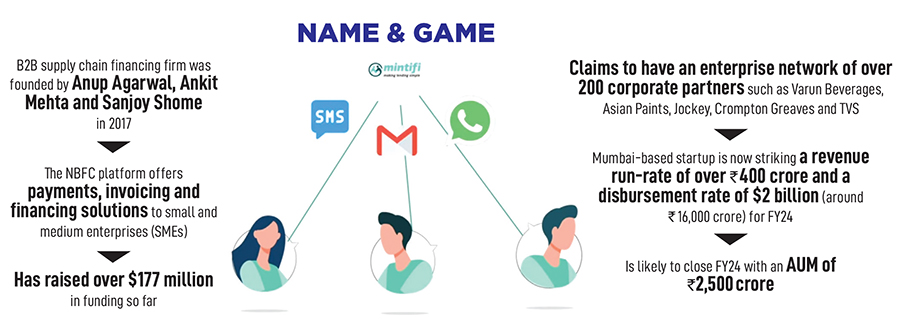

Meanwhile, time was running out for the fledgling venture. Mintifi, a B2B supply chain financing firm that was started by Agarwal, Ankit Mehta and Sanjoy Shome in 2017, had so far managed to run the show by using half a million dollars that Agarwal had pumped into the business. After almost a year of bootstrapped life, Mintifi now needed venture money to grow. Though the idea behind Mintifi was freshly minted, the funding pitch unfortunately was viewed by the VCs from a stale lens: Yet another fintech, yet another NBFC, and yet another clone in a cluttered market. There were no takers.

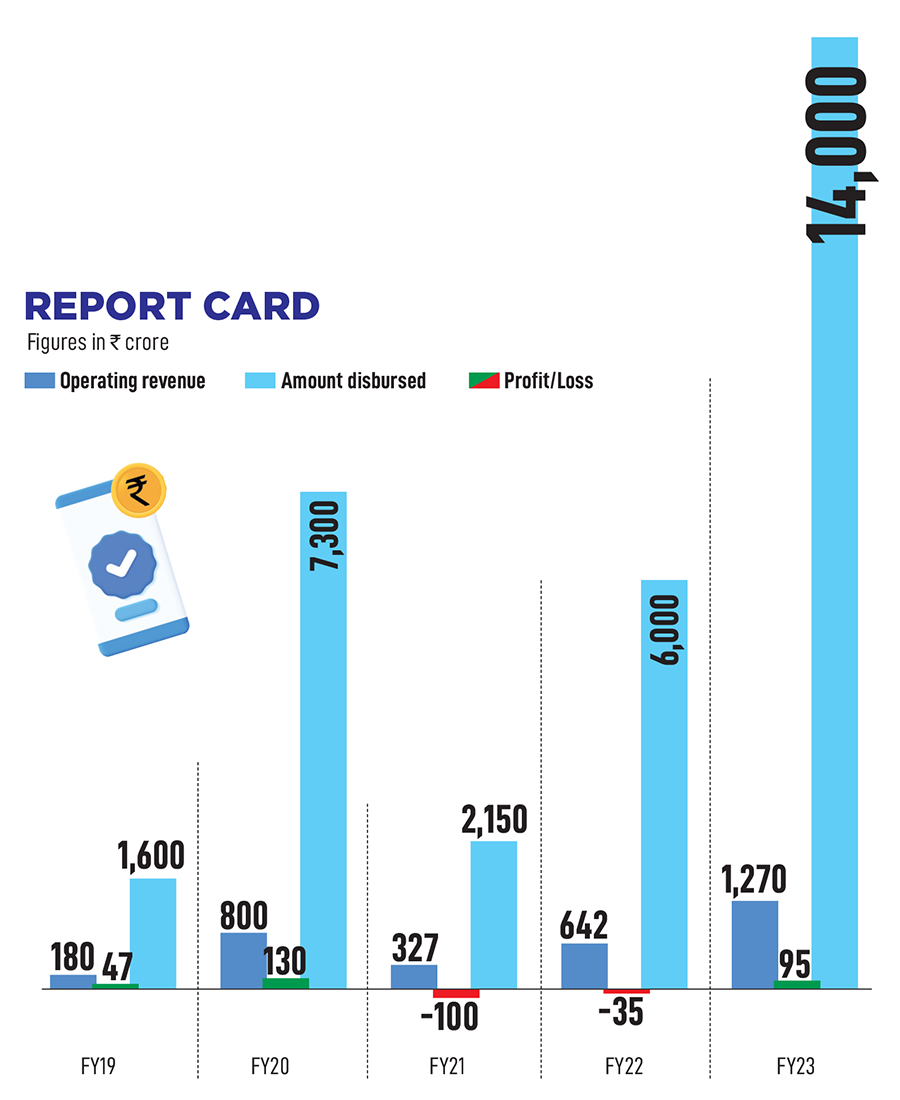

Five years later, in July 2022, there were again no takers. This time, Agarwal was stunned beyond belief. It had just been four months since Mintifi closed the Series C round of funding of $40 million in February 2022, and now the founder was again out in the market to raise a new round. The desperation to raise more was not hard to fathom. First, Mintifi was growing at a furious pace. Look at the numbers. From ₹30 crore in FY19, the amount disbursed in FY22 stood at a staggering ₹1,500 crore; and the revenue during the same period jumped from ₹2.8 crore to ₹59 crore. In a business where the core raw material happens to be money, Mintifi needed more money to keep the rocket cruising. And there was a compelling reason to believe that the founders would be amply rewarded. Why? After three consecutive years of losses, Mintifi had posted a tidy profit of ₹3 crore in FY22.

The second reason to raise back-to-back rounds of money stemmed from macro factors. The previous year, the global fintech world was in turmoil. In June 2022, the stock of the American online lender Affirm had plunged 78 percent from its valuation high of $12 billion. The following month, in July, it was the turn of Europe’s highest-valued startup to face the heat. Klarna’s valuation was slashed by 85 percent to $6.7 billion from $45 billion. Sweden’s fintech major, best known for its ‘buy now pay later’ service, was in the midst of a meltdown. Most of the fintech players, too, faced a similar fate, which triggered a knee-jerk reaction from investors. First, they shunned fintech stocks and investments. Second, fintech was left in a bitter funding cold.

Back in India, Agarwal had a weird issue to contend with. “I don’t think you guys are serious,” was the reaction of most of the VCs. And nobody could blame them for their disbelief. It had just been four months since the last fund raise. “Why do you need money now? What happened to the capital that you raised in the last round…,” were the questions hurled at Agarwal, who answered them to the best of his abilities. But it didn’t cut ice.

After a month, the founder saw some interest from a section of VCs. But the needle didn’t move. Why? All of them wanted to put money at the last round’s valuation. “Guys, it has just been four months. What do you expect,” they tried to reason with the founder who had reportedly raised the Series C round in February at a $150-million valuation. Agarwal, though, had valid reasons to ask for more. Mintifi had grown 2.5x in just five months. “How could we settle for the old valuation,” he argued. There was no meeting ground, and Mintifi stopped exploring the market.

Also read: Of credit and credibility: Why Madhusudan Ekambaram and KreditBee get a strong vote of approval from investors

Two months later, in September 2022, Mintifi was swamped with in-bound offers at a much higher valuation. Lucrative term sheets started pouring in, which left Agarwal bemused. “Is there something wrong,” he asked himself. “What has triggered a sudden deluge,” he wondered, and kick-started the funding process in October. Within four months, Mintifi closed its Series D round of $120 million in March 2023. The valuation jumped from $150 million to $450 million, and so did the performance metrics. While operating revenue leapfrogged from ₹59 crore in FY22 to ₹227 crore in FY23, profit increased from ₹3 crore to ₹35 crore, and disbursement pole-vaulted from ₹1,500 crore to ₹6,000 crore during the same period.

A recent credit note by Crisil explains why Mintifi, which once struggled to find backers, and was then overwhelmed with investors’ interest. Mintifi, the ratings agency pointed out in June, operates with a differentiated business model that has a greater focus on funding large corporates with an established track record. Mintifi, the note underlines, partners with corporates and offers supply chain financing (SCF) across its distribution network. The main product, a short-term revolving SCF, is spread over a short tenure of up to 90 days and ensures control over end-use of funds and offers higher visibility on cash flows of the customer. Since inception, the group has maintained relationships with multiple corporates and is continuously increasing its partner base. “Resultantly, the consolidated asset under management has grown to ₹1,183 crore as on March 31, 2023, from ₹141 crore in March 31, 2021,” it points out, adding that Mintifi caters to a vast end-user base from multiple industries.

A sticky customer base and strong report card is what made Niren Shah eventually back the startup. “I have known Anup Agarwal since 2012, and had immense respect for his entrepreneurial instincts, huge vision and ability to execute,” says the managing director at Norwest India. The deep value proposition, coupled with industry leading credit quality driven by dynamic tech-driven underwriting and the exceptional pedigree of the founding team, made Norwest back the founders, reckons Shah. “Post-investment, Mintifi has consistently outperformed our plans, making our decision to double down on the investment a no-brainer,” he adds. As the startup scales in its journey, the investor points out the likely challenge, it would face competition from traditional banks and larger NBFCs. “However, this is not a winner-take-all market, and there exists ample room for growth,” he says.

Meanwhile, Agarwal tells us why, in spite of raising a $100 million-plus funding round, he can’t be casual in his approach. “Let’s accept it. We were just very lucky to get the funding,” he says, adding that the industry has many performers, and they are not the only ones who dazzled with their metrics. “It was just one of the days when Australia pipped India,” he says, alluding to the recently-concluded cricket World Cup where India lost just one match, which happened to be the final. “We just need to keep our heads down and keep executing ruthlessly towards building a sustainable business,” he says. Minting money, after all, is what will lead to more funding, higher valuation, and an expansive business.

(This story appears in the 12 January, 2024 issue of Forbes India. To visit our Archives, click here.)