Inside LTIMindtree's $10 billion plan

"When there is a crisis, stay close to your clients," says LTIMindtree's CEO and MD Debashis Chatterjee. Carrying the lesson learned from the Covid-19 pandemic, the IT services veteran is now positioning India's fifth biggest IT services provider by market cap to hit $10 billion in revenue in the next four to five years, from roughly $3.5 billion in FY22

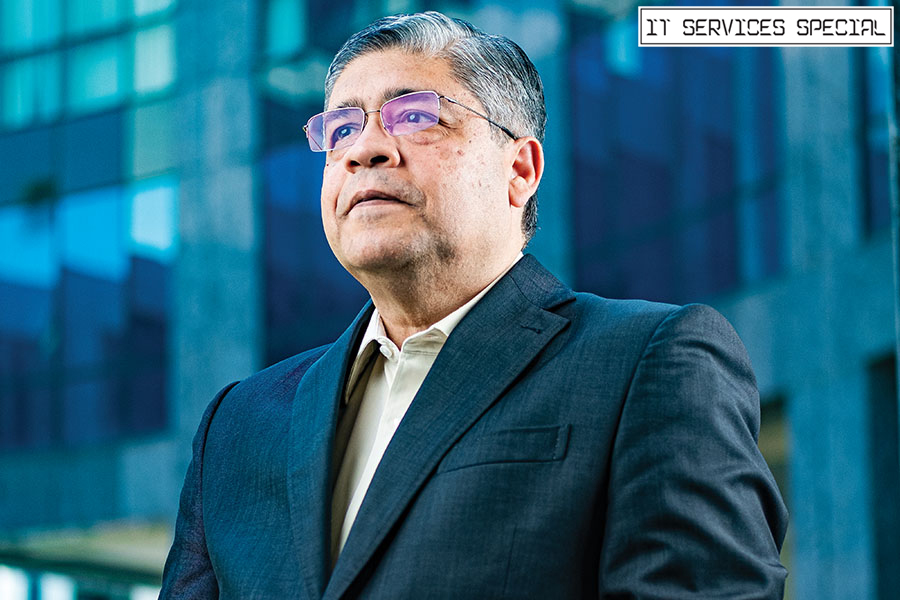

Debashis Chatterjee, MD & CEO, LTIMindtree

Image: Nishant Ratnakar for Forbes India

Debashis Chatterjee, MD & CEO, LTIMindtree

Image: Nishant Ratnakar for Forbes IndiaRemember reading about the brainstorming sessions organised by Francisco D’Souza, then CEO of Cognizant Technology Solutions, at the Sheraton airport hotel in Frankfurt, Germany, around the time of the global financial crisis?

One executive who was there was soaking up the lessons from D’Souza’s thought processes on how to deal with the fallout.

More than a decade later, in 2019, when that executive walked away from heading a portfolio accounting for close to 40 percent of Cognizant’s revenues to go run Mindtree—under its new owner Larsen & Toubro—those lessons, which had stayed with him, made a difference.

This time, the black swan came in the form of a virus that brought the world to a standstill. One lesson was “when there is a crisis, stay close to your clients”, Debashis Chatterjee, now CEO and MD of the combined LTIMindtree, recalls.

When, overnight, half the business evaporated from the travel and hospitality practice, which contributed about 17 percent of Mindtree’s business then, Chatterjee kept his cool. “We did not lose a single client,” he recalls. “All that business came back when the situation got better.”

“He saw Francisco as a mentor,” says a person who was intimately aware of what was happening at the Frankfurt meetings—as those sessions later came to be known. Chatterjee, 57, one of Cognizant’s earliest employees, spent more than 22 years there, broken only by a one-year hiatus at IBM.

“If you look at what Francisco did... during the great financial crisis, one of the forward-thinking things was, he went aggressive and hired several great leaders at the time, when others were firing,” the person said. “The results would show two years later, when Cognizant began to pull ahead of competition.”

“If you look at what Francisco did... during the great financial crisis, one of the forward-thinking things was, he went aggressive and hired several great leaders at the time, when others were firing,” the person said. “The results would show two years later, when Cognizant began to pull ahead of competition.” And in early 2008, when Cognizant acquired the Indian unit of T-Systems, a Deutsche Telekom unit, “the entire M&A discussion happened in the basement conference room in that Frankfurt hotel… and DC played a central role in that acquisition,” according to the person, who was closely aware of how that deal went down.

Later, the top executives would joke that the next Frankfurt meeting would be in Orlando, and the one after that would be in London… so “Frankfurt meetings”, which eased from the weekend-after-weekend effort during the first few months of the financial crisis to a quarterly exercise, became a symbolic term to describe the top bosses meeting to thrash out important plans.

And Chatterjee, who had already risen to head Cognizant’s biggest business at the time, as senior vice president of banking and financial services, remained in the thick of it. When he left for Mindtree, he was an executive vice president, and president of global delivery and digital systems and technology. In 2019, Cognizant made $16.8 billion in revenue, and digital tech services accounted for close to 40 percent of that.

Bigger and smaller

One aspect of L&T’s acquisition of Mindtree and its merger with Larsen & Toubro Infotech (LTI) that’s been talked up is that they bring complementary capabilities and only a sliver of customer overlap. From that point of view, Chatterjee gets to lead a combination that is no longer a smaller player and raring to get into the bigger leagues.“Mindtree came with an experience DNA and LTI brought in an engineering DNA with respect to supply chain transformation,” Chatterjee says. Together, “they give us an opportunity to serve our customers end-to-end”, he says.

“We are no longer a mid-tier company. We are also not a so-called tier-one company in terms of size, but we are in a position where we have the capabilities that a tier-one can provide, but also the agility of a smaller company,” he says. “So, we want to really capitalise on that.”

Chatterjee gets to run the combined company at a time when the world is coming out of a terrible pandemic—that pushed the company’s largest customers to embrace technology—and heading into a potential recession in America, the IT services sector’s most vital market.

He is of the view that even though the current macroeconomic conditions will slow down spending, the shift towards using technology at unprecedented levels is irreversible. Businesses are in mid-transformation and “you can’t really kill them (those projects). You can slow down a little bit, you can put a pause, but that transformation has to continue”.

Also read: IT services: Growth likely to continue despite tough economic conditions

Today, conversations are once again revolving more around “cost take-outs and efficiency, but in-flight transformation cannot be stopped because a lot of investments have gone in over the last two years in terms of reinventing the business models”, he says.

“Heritage Mindtree”, as executives within the combined company like to call it, helped customers improve customer experience, for example, or build omnichannel applications, or applications around software like Salesforce—all of which could bring in more revenue for those businesses. “Heritage LTI”, on the other hand, excelled at improving supply-chain operations.

There was also not much of an overlap of the verticals they served. If Mindtree excelled in serving travel and hospitality customers, LTI had strengths in the energy, and oil and gas vertical.

Mumbai’s Larsen & Toubro, India’s best-known industrial engineering company, acquired Mindtree in 2019 in what was seen as something of a hostile takeover, buying out the late VG Siddhartha, one of Mindtree’s largest shareholders, and then acquiring the rest from the market via an open offer. Mindtree’s entrepreneurial founders left, and Chatterjee was named the new CEO and MD.

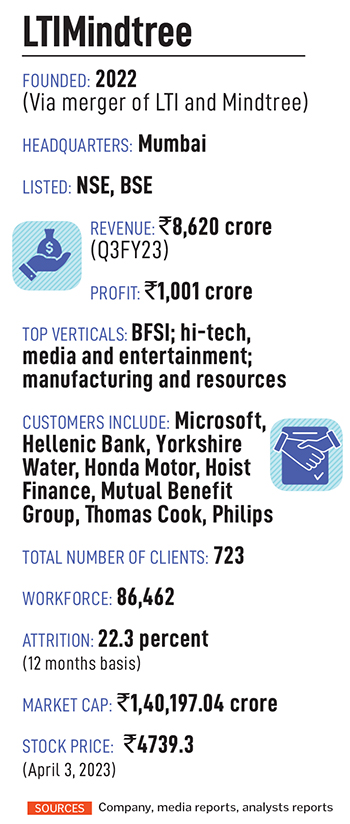

The merger made the combined entity a $3.5 billion company, India’s sixth biggest IT services provider by revenue, and fifth biggest by market cap. For the three months ended December 31, 2022, LTIMindtree reported revenues of $1.05 billion, a 16.3 percent increase year on year in constant currency, and an order book of $1.25 billion. The company had more than 86,400 employees.

With chairman AM Naik aspiring to create an IT giant in its own right within the L&T Group, Mindtree’s merger with LTI was always a fait accompli. It was only a matter of time. For now, L&T Technology Services (LTTS), the other tech services company within the group, which focuses on being a pure-play engineering services provider, has been kept out of the ambit of this combination.

The merger was announced on May 6 last year, and the regulators’ nod came through on November 14. A steering committee was formed that included Chatterjee and other top executives such as Sudhir Chaturvedi, president, markets. Given that both the companies were listed, the actual integration could only start on November 14.

That they were public companies also meant that until the regulatory approvals were in, “what we could not do was share actual data on customers, people or competencies”, says chief operating officer Nachiket Deshpande, another Cognizant veteran who joined LTI. “So that had to wait for day one.”

Deshpande says this has been one of the swiftest integrations in the sector in India. The minimal overlap of customers also meant that fewer people were affected in middle management, which is where much of the “disturbance” is typically seen in these kinds of exercises, he says.

On the shareholding front, shareholders of Mindtree got 73 shares of LTI for every 100 shares of Mindtree. Shares of LTI would then trade as the stock of the combined LTIMindtree.

But even before all this, over the last three years, top executives within the companies had established a playbook that allowed them to collaborate, Chatterjee says. Now, as a combined entity, there is the real opportunity of cross-selling and up-selling to some 700 customers, of which only about a dozen accounts were common to the individual companies.

The second opportunity is in terms of the size and scope of the contracts the combined company can now go after. There were situations, Chatterjee admits, where the individual companies were considered not big enough, for certain RFPs (request for proposal)—that biggies like TCS tend to dominate—but now they are twice the size.

There are at least “a couple of orders” in the works in the near term that the combined entity is going after, and “quite a few” that are being discussed with longer time horizons, Chatterjee says. “Customers are excited too,” he says, because clients from one company are getting exposed to the capabilities of the other.

An example from the early days after the merger was a client in the travel technology space looking at an applications modernisation programme, says Chaturvedi. In the past, as individual companies, LTI or Mindtree could have either offered the ERP (enterprise resource planning—business management software) part of it or the travel domain expertise.

“Now when we put this together, suddenly we became the end-to-end player that they wanted to see because in each of these areas our capabilities are at par with the best in the industry,” he says.

Not everything has gone like clockwork. As top executives focussed on the integration, several young aspirants, who graduated from college in 2022 and were made offers in late 2021 via LTI and Mindtree’s campus recruitment exercises are still waiting to hear about their joining dates.

After Forbes India published a podcast interview with Chatterjee on March 6, many of these graduates added posts on LinkedIn asking for updates on their joining dates. To be sure, “onboarding”, as it’s called in the industry, of campus recruits has been delayed across the sector, and this isn’t unique to LTIMindtree. But possibly, the processes could have been managed better.

“Like others in our industry, we continue to assess evolving customer needs, which play a critical role in our hiring plans. We appreciate the commitment and patience of all the candidates, and we sincerely regret the delay in our process to onboard them,” Deshpande said in a separate emailed statement on March 20.

“We are in the middle of LTIMindtree integration and given the scale of this merger, we had to make slight adjustments to our fresher onboarding plans. Currently, we are reassessing the combined needs of the merged entity and we will continue to explore opportunities to onboard remaining candidates in a phased manner, in alignment to business demand,” he added.

Four pillars of culture

“The integration is still going on as we speak, and our estimate is that by the end of March, maybe a couple of weeks into April, we should be done with all the systems, processes, all integration that is required so that everybody will be on one system,” Chatterjee says.In the near term, there weren’t any big surprises. There was time to plan, so the biggest challenge was more about successfully implementing the plan—“executing” as business managers like to say.

The minimal overlap, “1 percent of our total accounts”, as Chaturvedi put it, helped in important ways. It meant, for example, “client interfaces” could largely remain the same—excluding those who left, customers could continue to see familiar faces.

Such advantages helped ensure that there was “minimal change and zero disruption for clients”, says Chaturvedi.

The culture of the combined entity rests on four pillars, Chatterjee says. One is to be a purpose-driven company. The second is to have empathy for every individual employee, and the third is to make them “future ready” with training and so on, and finally, don’t lose the focus on results—the impact of the outcomes that LTIMindtree can deliver, he says.

“When I walked into Mindtree on August 2, 2019, a fundamental principle that I followed was to understand Mindtree and preserve the best of Mindtree,” he says.

It wasn’t made easy because a good part of his top leadership was missing, as some executives had left after the acquisition. His new CFO came on board a year later, for example. “That first year, I didn’t get much sleep,” he says.

Later, he also engaged an external consultancy to talk to more than 10,000 employees at Mindtree “to try to understand the culture we have”, he says.

One interesting takeaway was that there was a lot of importance given to learning, but sometimes it lacked alignment with the end outcome for customers. “So, that alignment is something which I brought in… a win-win for everyone,” says Chatterjee.

Then there were situations where the company would be offered a first-of-a-kind project which would be costly to say no to, but which also required its own level of risk management. “We strengthened some of these areas.”

Or many a time, with the project-based opportunities that Mindtree was good at, after the project was over, there would be a maintenance opportunity “which you were leaving on the table” for someone else to grab.

“So, we actually formed a large deals team, a strategic team, very early in my days at Mindtree.” The team helped the company to take the best of its projects capabilities and build the wherewithal to deliver large annuity deals, he says. “In the very first year we announced quite a few annuity deals,” which weren’t very well known in “heritage Mindtree,” he says.

“I did not kill projects. You need to run these programmes, but you need to also think of how you make them multi-year,” he adds.

“Once DC has an appreciation of the task at hand, he is always looking for creative approaches and solutions to re-invent the status quo,” D’Souza, co-founder and managing partner at New York private equity firm RECOGNIZE, says (See: ‘He’s single-minded in his execution focus’).

And Chatterjee thrives in situations of stress that put him outside his comfort zone, D’Souza adds—a great quality for a CEO at any time, but even more relevant in times like now.

Also read: On old school giving: Susmita and Subroto Bagchi, and Radha and NS Parthasarathy

Four programmes of growth

Chaturvedi says LTIMindtree will thrive by finding the pockets of growth that are bound to exist even in tough times. For example, he expects verticals, including banking and financial services and energy and utilities, to continue to invest in tech and tech services. LTIMindtree is gearing up through four programmes of growth, he says.“We have a very good blue-chip client base in each of the 10 industry sectors that we serve... this gives us resilience,” he says. Such customers typically take the long view and therefore will continue to invest in growth, while specific projects or timetables might be changed.

LTIMindtree has a programme called Aspire to focus on its top 100 accounts and its global 500 accounts. “We call them Focus 100,” he says.

The second programme is called Minecraft 2.0, an LTIMindtree version of a programme that previously existed. The idea here is simple. There are 374 customers each contributing $1 million or so in business. The combined LTIMindtree’s service line offerings to these customers have gone from three to eight, so the intention is to cross-sell to each of these 374 accounts so that those customers are using at least five or six services.

The third programme is called Everest, which is the company’s large deals effort. “Now we want to target deals beyond $100 million” much more aggressively, he says.

So, the company’s large deals team will study everything from upcoming renewals to competition and proactively propose deals to clients and to consultancies that advise and influence enterprise IT spending.

The fourth programme is called Neo, to add new customers. One vital part of this programme will be to win new customers around LTIMindtree’s partnerships with large tech providers like Amazon Web Services, Microsoft Azure and Google Cloud Platform. The company also has partnerships with business software providers such as SAP, Oracle, IBM and ServiceNow.

It has data management tech partnerships with companies like Snowflake and digital software partnerships with Adobe. There are also vertical-specific partnerships such as the one with Temenos for core banking or the one with Duck Creek for insurance.

The plan now is to tap the combined strengths of LTI and Mindtree to step up the effort in each of these programmes. And L&T’s connects around the world are a big asset, says Chaturvedi, who, along with L&T’s CEO and MD SN Subrahmanyan, did a whirlwind tour meeting 55 customer CEOs in two weeks.

$10 billion ambition

Subrahmanyan, who is also vice chairman of LTIMindtree, reiterated chairman Naik’s dream of “a large IT services company” on March 24, when he spoke at the Forbes India Leadership Awards, held in Mumbai on March 24, after accepting the Lifetime Achievement award on behalf of Naik.In November, after the merger was announced, multiple media reports cited Naik as saying LTIMindtree could go from $3.5 billion to more than $5 billion in a year.

“The vision that we have laid out for LTIMindtree is we want to help our clients’ businesses to grow faster, and to take their businesses to the future… together,” Chatterjee says.

By together, he includes the partnerships LTIMindtree has with the large technology companies that Chaturvedi mentioned.

He also wants to sustain the company’s profitable growth, and with the combined scale and capabilities of LTIMindtree, “we can probably convert that profitable growth into industry-leading over a period of time”, he says.

Therefore, from the L&T Group’s perspective, “the group definitely wants to see a $10 billion enterprise over the next four to five years”, Chatterjee says. He also hedges his bets a bit by adding that from Naik’s perspective, the group’s tech companies include L&T Technology Services.

LTTS, however, in the foreseeable future will likely remain a standalone company.

At LTIMindtree, Chatterjee may also soon be looking for attractive targets to buy, to deepen capabilities in emerging technologies and push further into the company’s biggest markets.

Overall, “we are very committed to creating a large IT services enterprise”.

(This story appears in the 21 April, 2023 issue of Forbes India. To visit our Archives, click here.)

Post Your Comment