From Mphasis to WNS, four midcaps changing the Indian IT game

We put the spotlight on four midcaps—Mphasis, Persistent Systems, Birlasoft and WNS—that are leveraging technology to the hilt, focusing on software innovation, helping clients accelerate their digital transformation ambitions and making strategic acquisitions to bolster growth

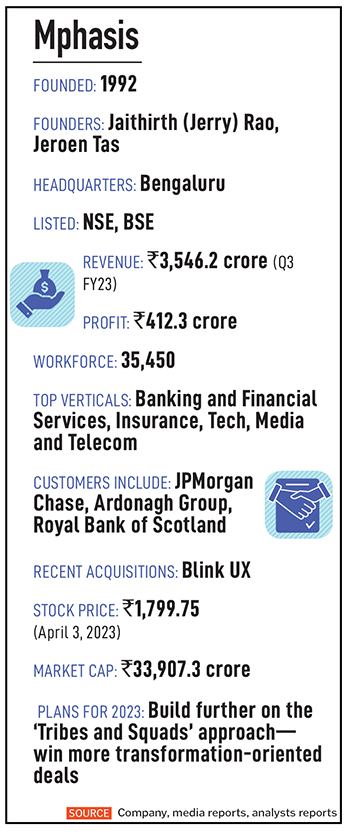

Mphasis: Emphasis on Growth

Nitin Rakesh, CEO and MD, Mphasis

Nitin Rakesh, CEO and MD, MphasisMphasis, as many would know, has a history of changing hands. And only two years ago, it looked like that would happen again. Then Blackstone, the world’s biggest money manager, and Mphasis’s owner, decided instead to commit more investments into the Bengaluru-headquartered IT company.

“A significant highlight for us from the recent past is our continued partnership with Blackstone and their long-term commitment. Blackstone’s reinvestment in Mphasis in 2021 through a fresh commitment from new funds is a strong vote of confidence for us,” says Nitin Rakesh, CEO and MD.

And the co-investment from the Abu Dhabi Investment Authority and The Regents of the University of California has opened new markets for the company, he adds. The transaction, in April 2021, was reported to be worth between $2 billion and $2.8 billion.

Co-founded originally by an ex-Citigroup executive some 25 years ago, Mphasis’s exposure to the banking and finance domains remains high. The flip side is also that large financial clients can be early movers in investing in strong tech services. Until recently, before LTI and Mindtree merged, Mphasis was the second largest of India’s mid-cap companies, behind LTI, with revenues of $1.59 billion in FY22.

Co-founded originally by an ex-Citigroup executive some 25 years ago, Mphasis’s exposure to the banking and finance domains remains high. The flip side is also that large financial clients can be early movers in investing in strong tech services. Until recently, before LTI and Mindtree merged, Mphasis was the second largest of India’s mid-cap companies, behind LTI, with revenues of $1.59 billion in FY22.“Despite the current macroeconomic environment, I see enterprises continuing to make investments in technology. And there are new market opportunities that we will seize,” Rakesh says. This trend will be particularly visible in the digital transformation space, as businesses look to modernise their operations and improve efficiency, he says.

For the quarter ended December 31, Mphasis’s reported revenues declined 2.5 percent quarter on quarter and grew 5.7 percent year-on-year, according to a press release on January 19.

This “reflects the duality in our current business environment”, Rakesh said in the press release. “On one hand, our core business continues to perform well. On the other hand, there are cyclical headwinds due to market hyper-sensitivity in our mortgage business, with interest rate movements.”

“We believe peak headwinds from the mortgage business are now behind,” analysts at Investec, an Anglo-South African financial group, wrote in a note to clients on January 23.

Exposure to this segment, which was sensitive to the rate hikes in the US, had contributed to Mphasis underperforming its peers for the first nine months of the fiscal year that ended on March 31, 2023, the analysts noted.

They also pointed out that Mphasis won $401 million in net new deals—the second highest total contract value reported by the company so far. This includes five large deals, of which one is more than $100 million.

Mphasis has also tended to rely on its top 10 clients and not as much on its $5 million clients or $1 million customers, analysts at Macquarie noted in a report in January, but added that it had the capabilities to continue to expand those accounts.

A historical risk that dates to Blackstone’s original purchase of Mphasis, in 2016, in the form of declining revenue from DXC should now be over, the analysts note. DXC, formed from the merger of HP’s enterprise services business and CSC, would offer close to a billion dollars in revenue commitments to Mphasis over five years—this was a sweetener HP had offered when it sold Mphasis to Blackstone.

Looking ahead, the tech sector, and businesses embracing tech in general, can turn the problems that arise in periods of crisis into opportunities, Rakesh wrote in 2021, in an award-winning business book co-authored with Jerry Wind, a respected Wharton School professor at the University of Pennsylvania.

On Mphasis’s opportunities, “we strongly believe that the migration to the cloud is a trend that has not fully played out across industries”, Rakesh says. Customers continue to prioritise the shift to the cloud for digital transformation and tapping data analytics for decision-making and customer service, he says.

Rakesh expects that enterprise adoption of artificial intelligence will become mainstream over the next three years, and the revolution of generative AI is the tipping point, he says.

Mphasis is working towards contextualising these models to specific domains and process needs of customers “by layering our AI and software engineering capabilities”, he adds.

On the people front, the company aims to increase the proportion of women in its workforce to 40 percent by 2025 from 35 percent in FY22.

Also read: Debashis Chatterjee's leadership mantras

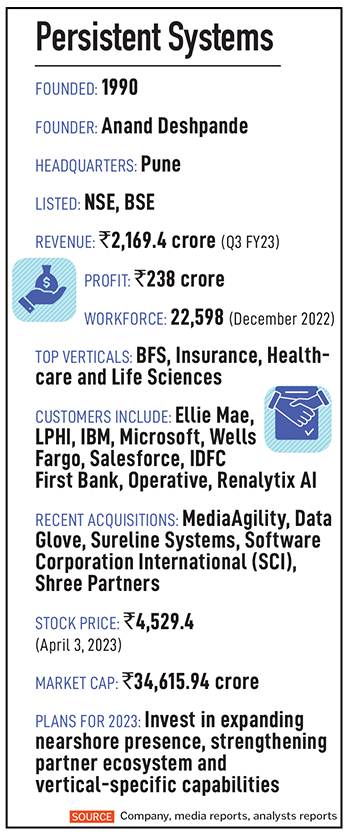

Persistent Systems: Adding Depth To Its Capabilities

Sandeep Kalra, CEO & Executive Director, Persistent Systems

Sandeep Kalra, CEO & Executive Director, Persistent Systems Persistent Systems got a new CEO in Sandeep Kalra right in the middle of the Covid pandemic. Founder Anand Deshpande seems to have got it right the second time after his previous attempt at handing over the CEO role to a professional CEO was relatively short-lived.

Christopher O’Connor, an IBM executive, who was named Deshpande’s successor in February 2019, left in August 2020. Kalra, an HCL Tech veteran who later worked at Samsung (via HARMAN), took over in October 2020. Analysts tracking the company have observed that the company, on Kalra’s watch, has acquitted itself very well, so far.

In fact, when the influential analysts at Australia’s Macquarie group released a new framework to track mid-cap IT services companies, they chose Persistent as their top pick, in a report in January. They chose Persistent ahead of even LTIMindtree on that list of seven mid-cap companies they analysed.

“Persistent Systems has improved its client mining significantly under Sandeep Kalra,” Macquarie’s analysts wrote in the report. The company “has continued to grow its average account size very well” over multiple years, and its growth ahead will likely be “broad-based and sustainable”, they wrote.

“Persistent Systems has improved its client mining significantly under Sandeep Kalra,” Macquarie’s analysts wrote in the report. The company “has continued to grow its average account size very well” over multiple years, and its growth ahead will likely be “broad-based and sustainable”, they wrote.For the quarter ended December 31, Persistent reported revenues of $264.35 million, a 3.4 percent increase over the previous quarter, and a 32.8 percent increase from the year-ago period. Profits rose 35 percent year-on-year to ₹238 crore (India’s IT services companies earn their revenue mostly in dollars, and profits are reported in India in rupee terms).

“We are a fast-growing digital engineering company that has hit $1 billion in annualised revenue run rate,” Kalra says. “We have focussed on going up the value chain, strengthening our talent base, and ultimately unlocking shareholder value.” Over the last three years, the company has delivered a 474 percent increase in the value of its stock.

An October 2021 report by Mumbai brokerage Nirmal Bang holds out an important clue to one aspect of Persistent’s strong growth under Kalra. The company made some strategic acquisitions that helped it add depth to its capabilities in banking, financial services, and insurance, or BFSI—the biggest revenue contributor to India’s IT sector.

Persistent’s acquisition of Software Corporation International (SCI) and its affiliate, Fusion360, for about $53 million bought it relationships with 10 of the top 20 banks in the US, and many of those relationships were well-established, being more than five years old, Nirmal Bang analyst and head of research Girish Pai wrote in that report.

The report named Wells Fargo, one of America’s biggest banks, as a top 10 customer of Persistent. He had an “accumulate” rating on the stock at the time.

“In the past 10 quarters, we’ve spent more than $200 million on multiple tuck-in acquisitions to reinforce our capabilities,” Kalra says. Areas of investments include hyper-scaler clouds (Amazon Web Services, Microsoft Azure, Google Cloud Platform), Salesforce, payments, and integration services. The company has also expanded its geographical footprint, he says.

The SCI acquisition strengthened capabilities around an IBM payments software product called FTM (Financial Transaction Manager) for which Persistent was providing product engineering. The acquisition gave Persistent the opportunity to “significantly expand” the payments business (in the US)—not only in FTM but also on other software platforms like Zelle, Pai noted in his report.

Persistent has hired several strategic leaders, and launched an employee stock option plan covering 80 percent of its more than 22,500 staff.

“Looking ahead, we’re focusing on laying the foundation for our journey to $2 billion in annual revenue and beyond,” Kalra says.

While the near-term imperative is to help clients save money, during the economic slowdown, software innovation is the differentiating ingredient for most enterprise brands today, he says. Persistent will offer its software engineering prowess in hi-tech, banking, financial services and insurance, health care and life sciences, and telecom.

The company will also expand into consumer, retail and consumer packaged goods, and media, and expand and deepen its partnerships. Over the next three years, “we aim to become the partner of choice for our customers in our areas of focus”, he says.

Also read: IT services: Growth likely to continue despite tough economic conditions

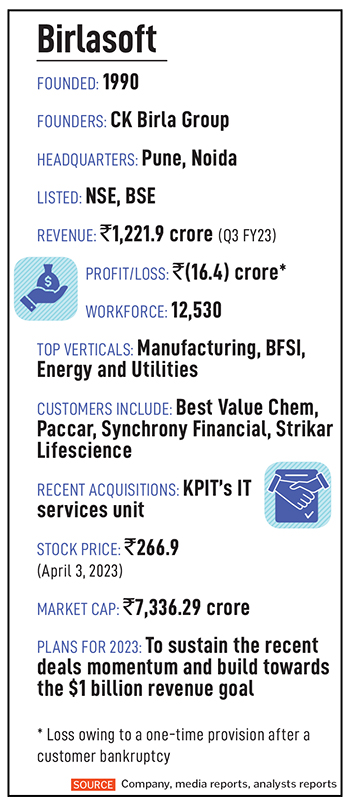

Birlasoft: Waiting to Surprise

Angan Guha’s tenure as CEO and MD of Birlasoft

Image: Neha Mithbawkar for Forbes India

Angan Guha’s tenure as CEO and MD of Birlasoft

Image: Neha Mithbawkar for Forbes IndiaIt would be a fair assessment to say Angan Guha’s tenure as CEO and MD of Birlasoft has gotten off to a rough start due to circumstances outside his control.

After 29 years at Wipro, where he rose to be chief executive of the company’s Americas business, Guha, an NRI, took over the top job at Birlasoft in December 2022. In the very first quarter during his new assignment, Invacare, an American medical devices maker and a large client of Birlasoft, filed for bankruptcy.

That put in jeopardy a sizeable chunk of a 10-year, $240 million contract that Birlasoft had won in October 2019 from Invacare. The Pune-headquartered IT company made a provision of ₹158.4 crore and reported a loss of ₹16.4 crore in its fiscal Q3 of the year that ended March 31.

CFO Chandrasekar Thyagarajan resigned as well, citing personal reasons, according to a filing with the stock exchanges. The CK Birla group company is looking for a replacement.

CFO Chandrasekar Thyagarajan resigned as well, citing personal reasons, according to a filing with the stock exchanges. The CK Birla group company is looking for a replacement.Revenue for the third quarter was $148.4 million, a 5.5 percent increase year-on-year, in constant currency, and flat versus the previous quarter, the company said in a press release. The company reported strong deal wins of $231 million in total contract value during the quarter.

In 2018, Birlasoft got a fillip with an innovative merger and demerger the company orchestrated with KPIT—the former consolidating all the IT services businesses of the two companies and the latter emerging as a focussed engineering services provider to automotive clients.

The acquisition added strong capabilities from the enterprise product and cloud companies such as SAP, Oracle, JDE and Salesforce.com. The company also gained expertise in analytics, robotic process automation, digital portals, user experience and digital advisory services. It boosted its business in the traditional outsourcing areas of application development, support and maintenance.

Another noteworthy achievement at the company is that it has scaled its business around Microsoft Azure to a $100 million revenue practice in just two years after forming a strategic alliance with the tech giant in 2020.

The company is offering Microsoft cloud services to more than 100 clients and boasts of over 3,000 employees trained on Microsoft technologies. And it has delivered more than 600 projects in areas including migration and modernisation, data, artificial intelligence and Internet of Things, according to an emailed note from the company.

Birlasoft “could surprise with a growth turnaround”, analysts at Macquarie wrote in their January report. With the Invacare order, Birlasoft “demonstrated a capability to do turnkey outsourcing deals”, they wrote.

“Our channel checks suggest strong domain expertise in insurance as well for Birlasoft and with a new CEO (Angan Guha) from much bigger peer Wipro, we could see a scale-up in BFSI,” the analysts added. This is significant because BFSI is a core vertical for almost every Indian IT services firm that has managed to scale up beyond $1 billion in revenue, they mention.

Birlasoft has demonstrated large deal capability could lead it to win similar deals in the global 1,000 “and surprise us positively on growth”, they continued.

“I have spent a lot of time meeting our customers and teams across all the functions,” Guha says. In addition to investments in promising growth areas, “we will transform the company from a culture standpoint and that’s important to me personally”, he says.

“The business is fundamentally robust and we are making the investments necessary for future growth, which makes me confident about our outlook. We are committed to a $1 billion revenue goal,” he adds.

Birlasoft recently inaugurated a 250-seat delivery centre in Coimbatore, focussed on cloud services, digital and software testing. It has also partnered with Coursera and opened up higher learning from Ivy League Universities for its nearly 13,000 staff.

Also read: IT services Q3 earnings: Five takeaways from the top companies

WNS: Business Process Sophistication

Keshav Murugesh, CEO, WNS

Keshav Murugesh, CEO, WNSOne of the most cynical depictions of India’s BPO sector appeared in the Hollywood blockbuster Transformers (2007) with a nose-picking telecom company back-office agent talking back to a brave US commando fighting off an alien decepticon.

Such images have given way to business process management, which at the higher end includes machine learning and artificial intelligence-based automation, and consulting around digital technologies and platforms.

Three acquisitions made by WNS, one of India’s biggest BPM companies, all made within the second half of 2022, reflect this change in the sector.

Originally born as a unit of British Airways, WNS today is among India’s biggest BPM companies. The Mumbai-headquartered company has operations from the US to Australia, and from China to South Africa. It reflects how this segment has changed and continues to evolve.

Originally born as a unit of British Airways, WNS today is among India’s biggest BPM companies. The Mumbai-headquartered company has operations from the US to Australia, and from China to South Africa. It reflects how this segment has changed and continues to evolve.“If you look at what has also been happening at the back end, all of us as providers have been leveraging technology to the hilt, to connect with our own employees, train them, reskill or upskill them,” says Keshav Murugesh, CEO of WNS.

“We are also bringing in more accretive, synergistic kind of acquisitions to increase our offerings. It means that the value proposition of companies like WNS for clients and prospects has increased dramatically,” he says. As a result, the company is “seeing a very strong pipeline”, he adds.

For the quarter ended December 31, WNS reported revenues of $306.9 million, up 8 percent from $284.1 million in Q3 of last year and down 0.1 percent from $307.1 million for the previous quarter. Profit for Q3 of FY23 was $34.7 million compared with $34.3 million a year ago and $33.2 million for the September quarter.

WNS expected to end FY23 with revenue between $1.146 billion and $1.158 billion, up from $1.027 billion in FY22. This includes revenue from companies it acquired. In the last 12 months, WNS acquired three companies, spending upwards of $320 million in total.

Concerns about a recession in the US, combined with more solutions being offered by companies like WNS and the BPM sector’s access to talent in locations from Philippines to India to South Africa—instead of costly talent markets like Europe or the US—are all combining to “feed the pipeline”, Murugesh says.

Therefore, this is also an opportune period for the BPM companies to consolidate their capabilities via acquisitions, he says.

WNS announced the acquisition of Vuram, in Chennai, in July 2022. Vuram helps companies accelerate digital transformation by aligning, automating, and optimising processes using a combination of low-code software applications and intelligent automation platforms.

It can create custom BPM solutions, including the ability to extract, collect, and categorise data using OCR and AI-based document processing; and develop rule-based processing engines and machine learning-based augmentation, and exploit advanced analytics to improve decision-making.

Vuram has also created customisable, low-code, plug-and-play solutions across front, middle, and back-office functions, including industry-specific solutions for the banking, financial services, insurance, and health care verticals. Founded in 2011, Vuram was a team of about 900 people with digital skillsets in India, the US, Mexico, Australia, Canada, and the UK.

In December, WNS announced the acquisition of The Smart Cube in London, Britain, and OptiBuy in Warsaw, Poland. The Smart Cube, a 20-year-old company, provides digitally led market intelligence and analytics solutions in procurement and supply chain, commercial sales and marketing, digital and analytics, and strategy and investment research.

The Smart Cube uses a proprietary digital AI knowledge management platform called Amplifi Pro to help clients improve procurement, and market intelligence and insight-based decision-making. They also bring strong front-end advisory capabilities and a large European footprint to the WNS portfolio.

The company has over 800 global employees, including a seasoned leadership team with CXO-level relationships, and more than 600 talented R&A specialists (reporting and analysis) with approximately two-thirds of them holding a master’s degree.

OptiBuy was founded in 2010. It is a leading European provider of procurement platform consulting and implementation solutions. The company helps clients use the capabilities of third-party procurement and supply chain platforms, including Ivalua, Jaggaer, and O9, and complements WNS’s existing offerings with platforms such as Coupa and Ariba, WNS said in a press release in December.

OptiBuy also provides consulting, optimisation, outsourcing, and training services to its clients. Focussed on the EMEA market, the company had approximately 90 employees, including more than 40 senior-level certified platform implementation professionals based in Poland.

WNS sees the expansion of these capabilities into the North American market as a significant opportunity.

These purchases are “in line with our vision really to accelerate the digital journeys for our clients and these are ensuring significant strategic, operational and financial value enhancement”, Murugesh says. WNS can now “play in the end-to-end procurement space, from consulting all the way to running operations”, he says.

(This story appears in the 21 April, 2023 issue of Forbes India. To visit our Archives, click here.)

Post Your Comment