The RBI is doing the right stuff: Oliver Prill

It's rare to spot a fintech honcho who roots for the work done by RBI. It's rare to meet a chief executive officer who brutally admits that a section of old and new players, across the world and in India, didn't play by the book. And it's rare to meet a foreigner who confesses that 'Indian Chinese' is way better than authentic Chinese food. Meet the global CEO of Tide, a UK-based fintech platform for SMEs

Oliver Prill, Global chief executive officer (CEO), Tide

Image: Madhu Kapparath

Oliver Prill, Global chief executive officer (CEO), Tide

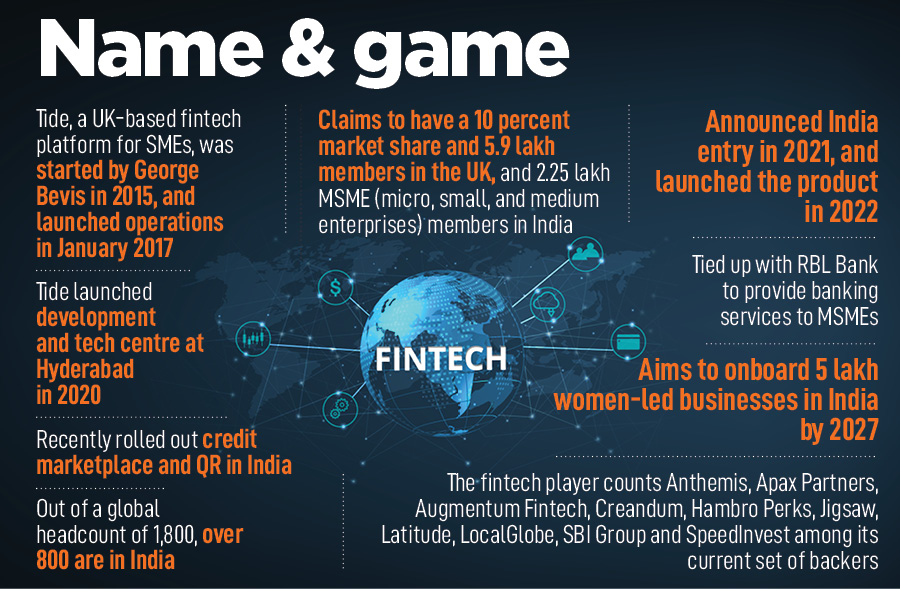

Image: Madhu Kapparath The timing of the comment is fortuitous. “You need to realise that regulators are there for a reason,” underlines Oliver Prill, the global chief executive officer (CEO)of Tide, a UK-based fintech platform for SMEs. A lot of people, reckons the top honcho of the fintech major, don't realise that the risk profile of regulators is asymmetric. “They don’t have an upside. There is only a downside,” says Prill, who was in India early this week to take stock of the operations of his startup, which announced its India launch in 2021, and rolled out operations a year later. “Most of them [regulators] are benevolent,” he underlines.

A little over 24 hours after Prill’s free-wheeling interview with Forbes India came the news that the banking regulator in India, the Reserve Bank of India (RBI), has barred Kotak Mahindra Bank from issuing new credit cards and onboarding new customers via online and mobile channels. The move is set to stoke the fire to a simmering debate on the purported high-handedness of the regulator, which has faced flak for its ‘tough’ action against Paytm Payments Bank, IIFL Finance, Visa and Mastercard earlier this year. A clutch of fintech founders, investors, analysts, industry experts and seasoned banking professionals was quick to denounce the regulator for its ‘harsh’ stand and alleged that the regulator’s overbearing attitude might do more harm than good.

Meanwhile, at Tide India’s office in Gurugram, Prill tells us why the Indian financial regulator must be commended for staying vigilant. “I don't think the whole notion in the press that regulators are trying to stifle growth is correct,” says the CEO, who spent over 20 years in global leadership roles across financial services, including banking and insurance, had worked with regulators across countries, and joined Tide in 2018. “But what about a loud chorus of disapproval of the way the Indian financial markets are regulated?” I try to evoke a blunt reply from the CEO who is known to speak his mind. “Is the Indian financial system highly regulated?” I tried to draw the fintech boss deep into a discussion pivoting around compliance and governance.

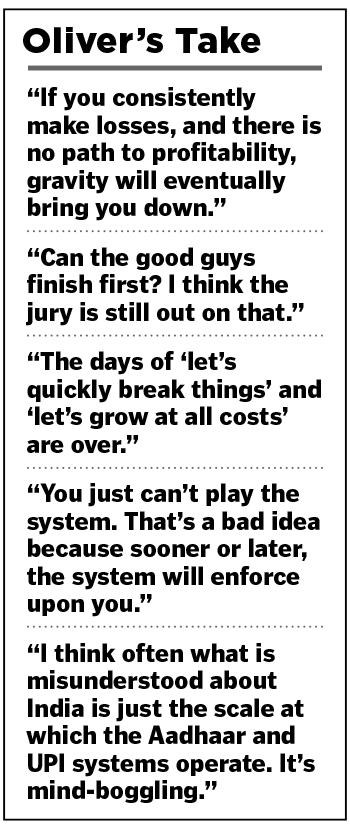

Prill stays true to his reputation of calling a spade a spade. Some of the fintech players, including established international players, the CEO reckons, may have thought they could get away with de-facto non-compliance. As a business leader, Prill continues to explain his point, one must realise that there is a democratically elected system that has empowered a regulator with asymmetric risk-return profiles to ensure that a sound financial system of protecting consumers is adhered to. “If you try to play the system, that's a bad idea. It’s bad because sooner or later, the system will enforce upon you,” he underscores, trying to put RBI’s actions in perspective. India had an old financial system that was quite heavily regulated. “And then the fintech world arrived. And not all played by the book,” he says. Consequently, the regulator had to adjust rapidly, and put a good framework around it. “We think that's a good thing,” he says.

In the fintech world, regulation is a welcome thing. Prill explains. The biggest thing in the fintech universe is confidence. “If there's no confidence by the consumers and small businesses in the infrastructure, banking and the fintech world, that's a bad thing. So we like the stuff done by the RBI,” he says, and quickly expands the scope of discussion on regulation and compliance by adding the US and Europe. “Let’s not make this an India-specific thing,” he says.

Even outside India, regulations are having the desired impact. “The bad guys are finding out that not only they don’t win but they may end up in the wrong place where they don’t want to spend the rest of their lives,” says Prill, adding that the regulatory landscape in the UK moved at a gradual pace. There were times when the UK also leaped ahead with open banking and so on. But those days are a bit dated now. “In terms of the extent of regulation, I am not sure whether India is more heavily regulated than the UK,” he says.

Yes, the big boys around the world, including India, too have been caught on the wrong side. But do fintech startups take the cake for brazenly flouting norms and not caring about compliance? Don’t you think that a raft of young founders was encouraged by an easy flow of dollars before the onset of the funding winter and was egged on by the philosophy of ‘break fast, fail fast, and scale fast’ to throw caution to the winds? Prill reckons that the heady days of funding—and its associated deviant behaviour—are a thing of the past. “I don’t think today someone will come and say let’s quickly break things and let’s not care about compliance,” he says. “Those days are over,” Prill tells Forbes India.

Also read: Has India resisted timely financial sector reforms? Rajrishi Singhal weighs in

On The Changing Indian Fintech Landscape

India has changed enormously. I'm very bullish about India. In the few years I've been associated with India, I've seen the change. It's just mind-boggling. So when I first got involved—some 15 years back—the India stack was in its infancy. I still remember, there were a lot of questions about how much would UPI be adopted. Will people accept Aadhaar IDs? Will any of the other things ever come through such as online corporate records and so on? All of that is now delivered on a scale that is just unbelievable. And I think often what is misunderstood about India is just the scale at which the Aadhaar and UPI systems operate. It’s mind-boggling.On The Thriving MSME Sector

India officially has 64 million MSMEs (micro small and medium enterprises). But if you look at the word MSME globally, people have different definitions such as informal sector and so on. We found that 8 to 9 percent of the population is the equivalent of MSME. That's a pretty good rule of thumb. Sometimes it’s a bit higher if the country is entrepreneurial, and at times a bit lower if the country is less entrepreneurial. India is arguably very entrepreneurial. So, you can safely assume that, in reality, there are 130 million MSMEs as opposed to the official number of 64 million.On Building a Sustainable Business

At Tide, we've always believed that one must grow sustainably. For us, the UK market is cash-flow positive. From the very beginning, we believe that you can’t build a business model in the end. You can invest upfront, and we're happy to invest globally. But in the end, there needs to be some return. Otherwise, it's like a ball you throw up in the air. At some stage, gravity will pull it down. It's as simple as that. We never believe in growth at all costs.

On Disruption-Growth Paradox

In the end, we believe that a valuable company can be built by doing the right things. And I've just been around for long enough. If you consistently make losses and have no path to profitability, gravity will eventually catch the ball. It will come down. You may be throwing it up. You may be very strong. It may travel for a long time. But that ball will come down. It may be in months or years. But in the end, it will come down. If you can't catch it then, you're done. Having a sensible business model as well as being compliant is not inconsistent with disruption.

On VCs Driving Irrational Behaviour

There's always the temptation of a VC to make a quick buck. And we see in many ways now with AI (artificial intelligence) and machine learning. But with the hype at which this goes, I can see that there's another bubble building. However, as much of the underlying trend is true, there will be challenges down the line. With everyone hyping things up and going over the investment curve, there is no question that (a fall) will come. With the VCs, there is a range of VCs that are leading and then there is a range of VCs that are following. The problem is—and this is what we saw during the last cycle as well—those who are leading will stop investing at the right time. But the followers continue and then they get messed up. So, there will be corrections in the system.The great news about the VC ecosystem, though, is that it adjusts very quickly to change. And a lot has changed over the last two years. One must be careful in branding as not all VCs and PEs are the same. There were always some that followed the philosophy of building a sensible business.

On Valuations & Compliance

In many ways, when I look at the current environment, and I contrast it with what it was two to three years back—heydays of funding—I would prefer the current environment. The present environment has brought back the value of sticking to the fundamentals: Let's not break things, let's be compliant, let's not grow at all costs, let's have unit economics and a proper financial strategy. During the peak of funding, it was hard for any company or startup that treaded on the conventional path. It was hard especially when everyone around was doing the opposite. It was frustrating. I do remember various VCs saying ‘you never won a prize’ for being the most compliant company. And I said, ‘No, we didn't’. My response to compliance is simple: You need a licence to operate. And if you're structurally non-compliant, business will not last. We're in a regulated industry and you need to follow the regulations.On The Tough Job Of Regulators In India

You have a country of great size. You have a population that is rapidly going through a path of wealth creation. But many people still lead simple lives. So, there can be a dramatic impact of them being affected by adverse things. In India, you have an enormous population. If things go wrong, they can go wrong at an enormous scale, just like when things go right, they go right at an enormous scale.On The ‘Ever-Adapting’ Indian Culture

Indian culture has something alien to Europeans. In Europe, we are always afraid of anything new. And the reason for that is we all have small countries that can easily be overwhelmed. India, for centuries, has just absorbed and Indianised things. And I think it does it in everything. Let's talk about fintech. India takes the best from the West and then makes it even better. On food too, India does the same. Indians take foreign food—whether it’s Chinese or Italian—and then Indianise it and make it a lot better. I love Indian Chinese. And anyone who believes that Italian Bolognese is better than Indian lamb Bolognese hasn't tasted the Indian one.The Indian mindset is completely different from the European mindset. In Europe, the population is ageing, and digital adoption has been a challenge. Though it did happen during Covid, it was still quite reluctant. But the ease with which the young and ambitious population in India takes to anything digital is just mind-boggling.

Post Your Comment