China drives into India

With India showing the potential to become the third-largest automobile market in the world, car makers from China are revving up to sell their vehicles here

China's Great Wall Motors has lined up investments worth Rs 7,500 crore for India

China's Great Wall Motors has lined up investments worth Rs 7,500 crore for India

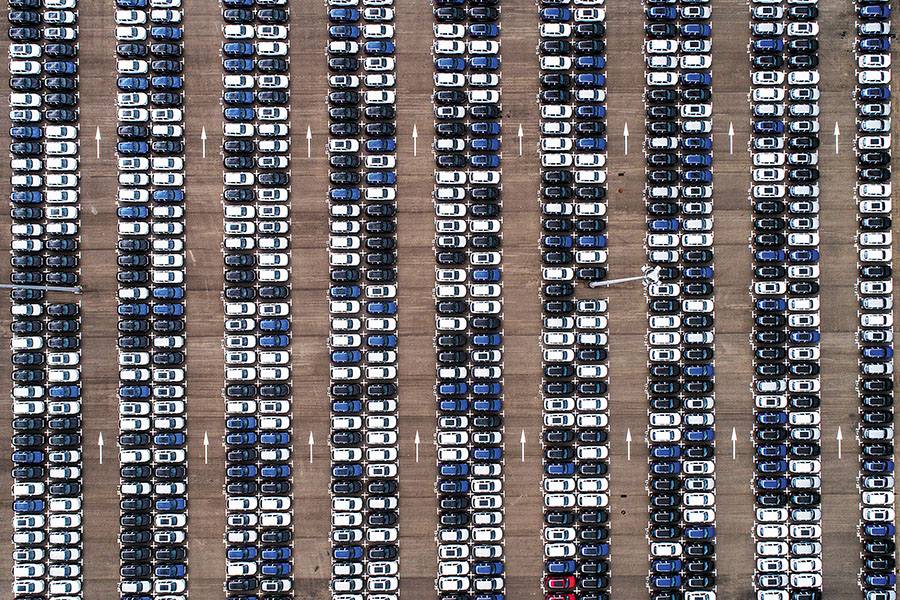

Image: Sergei Bobylev / Tass via Getty Images

Shanghai-headquartered SAIC Motor has been selling MG cars in India since last year

Shanghai-headquartered SAIC Motor has been selling MG cars in India since last yearImage: Wang Chun / VCG vis getty Images

(This story appears in the 27 March, 2020 issue of Forbes India. To visit our Archives, click here.)

Post Your Comment