How the Adani Group became India's largest airport operator

After becoming India's largest private port operator, the Gautam Adani-led Adani group has turned all its attention to its airport business, which it forayed into barely a year ago

Chhatrapati Shivaji International Airport, Mumbai. Photo by Satish Bate/Hindustan Times via Getty ImagesThere just seems to be no stopping the Adani juggernaut. Not even a pandemic.

Chhatrapati Shivaji International Airport, Mumbai. Photo by Satish Bate/Hindustan Times via Getty ImagesThere just seems to be no stopping the Adani juggernaut. Not even a pandemic.

Early this year, despite the Covid-19 pandemic wreaking havoc on the Indian economy, the Ahmedabad-based group splurged nearly Rs 15,000 crore to mop up three ports across India’s coastline to strengthen its role as India’s largest private port operator, accounting for over 25 percent of the cargo movements in the country. The group also sold a 20 percent stake in its barely six-year-old renewable energy company, Adani Green Energy, for $2.5 billion to Paris-based Total Energies. Last year, Adani Green had won the world's largest solar energy tender worth $6 billion.

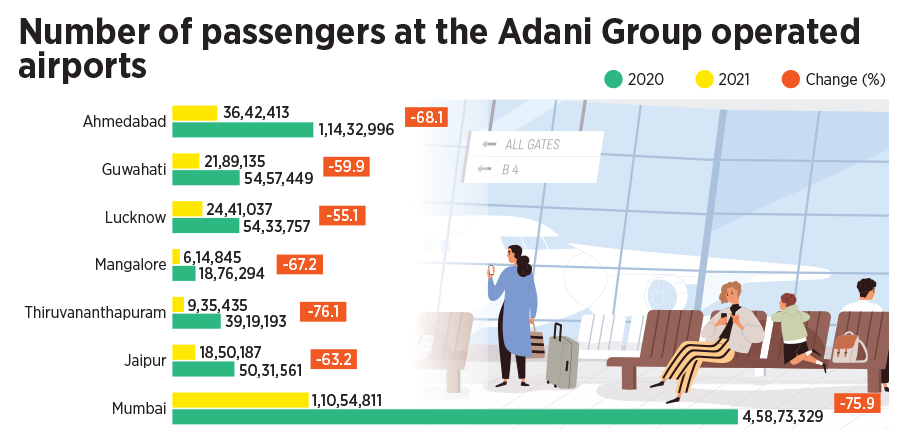

Then, on July 13, less than a year after it forayed into India’s lucrative airport sector, the 32-year-old Adani Group managed a rather rare feat, something that even pioneers in India’s airport sector had not managed so far: The group became India’s largest airport infrastructure company, with one in every four passengers in India passing through an airport they run. The group’s airports also account for one-third of all the air cargo in the country.

The steady climb to the top, particularly as India’s aviation sector traverses some turbulence, came after the group took control of the Mumbai airport, a key gateway to India’s financial capital. Through its subsidiary Adani Airport Holdings Ltd (AAHL), the group acquired the Mumbai airport from Hyderabad-based GVK group, after buying a 50.5 percent stake in Mumbai International Airport Ltd (MIAL) last year.

AAHL acquired another 23.5 percent stake this February for Rs 1,685 crore from the two foreign partners in the company, Airport Company of South Africa and Bidvest, increasing its stake to 74 percent. The government-owned Airports Authority of India (AAI) holds the remaining 26 percent in MIAL. “AAHL is now India's largest airport infrastructure company, accounting for 25 percent airport footfalls. With the addition of MIAL, it will now also control 33 percent of India’s air cargo traffic,” the Adani Group said in a statement.

The deal means, only the government of India, which controls 12 of the major ports and a host of airports through AAI, counts as its main rival when it comes to ports and airport infrastructure, both critical for passenger and cargo movements in one of the fastest-growing economies of the world.

“We are in the infrastructure business,” says Malay Mahadevia, CEO of AAHL. “In the long period of economic resurgence that India is moving into, each of the top 30 cities is expected to require two airports. The airport business holds several strategic adjacencies for our other B2B businesses, and allows us to interlink our B2B and B2C business models.”

Adani’s gamble in the sector comes at a time when the Indian aviation industry is experiencing one of its worst phases in recent times. Although India is expected to become the third-largest aviation market by 2025, according to the International Air Transport Association (IATA), the sector has been hit hard by the pandemic, forcing airlines to clamp down on movements, as business and leisure travel took a hit. Because of Covid-19, India’s airlines currently operate at 65 percent of their capacity. Despite airline companies shifting to the movement of cargo to stay afloat, they are expected to post a net loss of $4.1 billion, according to consultancy firm CAPA, while airport operators could be poorer by $1 billion in revenues in the current fiscal.

Yet, the Adani Group isn’t perturbed. If anything, it is only gearing up for a bigger play.

“The Adani Group’s airport expansion strategy aims to join India’s biggest cities in a hub-and-spoke model,” Mahadevia says. “This also means it will remain interested in more opportunities in the airport business wherever it allows us to add economic value that better bridges India’s urban and rural sectors.” A hub-and-spoke model is one where routes are organised like spokes from a central hub.

Chhatrapati Shivaji International Airport, Mumbai. Photo by Nicolas Economou/NurPhoto via Getty Images

Chhatrapati Shivaji International Airport, Mumbai. Photo by Nicolas Economou/NurPhoto via Getty ImagesHow Adani built the airport business

Adani’s foray into the airport sector two years ago, although not a surprise, had raised eyebrows. In February 2019, when the Indian government decided to invite private players to take over the operations, management, and development of six airports, the Adani Group had swept in, beating some 25 other firms to take control of the airports.

While the group had operated the private Mundra port in Gujarat's Kutch since 2007, it did not have significant expertise in operating commercial airports. Therefore, it helped that the government did away with the requirement of prior experience while bidding for the airports. Much of the decision to foray into the airport business was to do with the group’s plans to become a diversified infrastructure player. “As India’s largest infrastructure player, with a leadership position in the supply chain that involves ports, rail, road and storage, the airports business was the missing link,” says Mahadevia.

In March 2019, the group won the right to upgrade and operate the airports of Lucknow, Jaipur, Thiruvananthapuram, Mangaluru, Guwahati, and Ahmedabad after it offered higher per-passenger fees to AAI in its bids. It was the first time that the government had asked bidders to offer a fixed revenue per passenger, unlike earlier when operators had to share a part of their revenue.

Over a decade ago, the GMR Group had agreed to share 45.99 percent of revenue with AAI for developing the Delhi airport, while the GVK group offered 38.7 percent for the Mumbai airport. AAI changed the revenue share model because it felt operators weren’t showing enough revenue from airport operations, leading to lower payments.

Going very high: Promised per passenger fee

So far, the Adani Group has taken control of three—Mangaluru, Ahmedabad, and Lucknow—of the six airports for which it had submitted winning bids. While AAI had signed three concession agreements in January 2021 with the Adani Group for the operations, management, and development of the Guwahati, Jaipur, and Thiruvananthapuram airports, the group has sought a three-month extension on taking over them, due to current economic conditions.

The deliberate delay in taking over the airports has raised questions within the industry about the group’s inability to meet the high bid amounts. For instance, at Rs 115 per passenger for Mangaluru and Rs 171 for Lucknow, Adani Group’s bids were over 500 percent more than the lowest bids received from the GMR Group and PNC Infratech. Similarly, Adani Group's bid of Rs 177 for the Ahmedabad airport was nearly 200 percent more than the lowest bid of Rs 60 from Autostrade Indian Infrastructure Development Pvt Ltd.

The group, however, dismisses the concerns and reckons it was spot-on with its aggressive bids. “Our bids for the airports may have been higher than those of others but that is simply because we are well poised for a rapid build-out of our airport-focussed infrastructure,” Mahadevia says. “To us, airports infrastructure and management are an integrated model to scale up services and explore convergence with the preferences of a larger populace that includes non-fliers as well. The bids we made make business sense for a group that is confident about what it does and how it operates.”

In the fiscal year ended March 31, the airports for which Adani has won the right to operate handled 9 million passengers, while the Mumbai airport handled 11 million passengers. The company has also won the rights to develop the Navi Mumbai airport, close to Mumbai, by virtue of acquiring MIAL. (MIAL had won the rights to develop the Navi Mumbai airport after outbidding the GMR Group.)

Tough Times

“It is definitely an interesting way to come in,” says Satyendra Pandey, managing director at aviation consultancy firm AT-TV, about Adani’s foray into airports. “It was a no-brainer for the government to award them the projects since the bids were as much as five times the others in some cases. But, right now, it is something of a double whammy with traffic having dried up. The Mumbai airport, however, is a cash cow and for a constrained city like Mumbai, there is enormous potential in the future.”

For airport operators, much of their revenues come from non-aero verticals, which includes retail and monetising real estate across airports. Passenger traffic across India is set to swell and IATA reckons the number of fliers is set to touch 50 crore by 2037, even as airline companies struggle to keep up with the growing demand for pilots and fluctuating fuel prices.

“Our larger objective is to reinvent airports as ecosystems that drive local economic development and act as the nuclei around which we can catalyse aviation linked businesses,” Gautam Adani, Chairman of the Adani Group, had said at the time of the acquisition of MIAL. “These include metropolitan developments that span entertainment facilities, e-commerce and logistics capabilities, aviation-dependent industries, smart city developments, and other innovative business concepts.”

Big plans

Much of the Adani Group’s gamble in the airport business comes from a firm belief in airline traffic seeing a resurgence after months of lull. In the post-pandemic ecosystem, the group reckons it will be catering directly to a 300 million-strong consumer base comprising fliers and non-fliers.

Before the Adani Group’s entry, the major private companies in the airport sector included the GMR Group, which manages the Delhi, Hyderabad, and under-construction Mopa (Goa) airports, Zurich Airport (which is developing the Jewar airport near Noida), and Fairfax (Bengaluru airport). The GVK group exited the sector after losing the Mumbai and Navi Mumbai airports to Adani.

"The Adani Group's airports business should become its flagship capability, alongside its ports business where it commands pole position with excellence in operation, efficiency and seamless multi-modal integration both with rail and road transport,” says Mark Martin, founder and CEO of Dubai-based Martin Consulting, an aviation consultancy. “Airports as a business needs a company that looks at long-term returns on investment, with exit options coming in between 30 and 50 years. Given Adani's track record with its ports and SEZ businesses, running airports should be a no-brainer, as nearly all infrastructure capability has been in-sourced and established with fully owned strategic business units.”

In the meantime, the Indian government is expected to lease out seven more airports, including Bhubaneswar, Varanasi, Amritsar, Raipur, Indore, and Trichy as part of its privatisation plan, providing a massive opportunity to the Adani Group to further ramp up its presence. “As the economy normalises, revenues are expected to grow with the business, and international travel will accelerate as the world and India emerge from the pandemic,” Mahadevia says.

Already, growth in the sector is showing some signs of revival. For June 2021, domestic passenger traffic was estimated at 29-30 lakh, implying a sequential growth of 41-42 percent, compared to 19.8 lakh in May 2021, according to rating agency, ICRA. “The airlines’ capacity deployment for June 2021 was around 46 percent higher than June 2020 [31,700 departures in June 2021, against 21,696 departures in June 2020],” ICRA said in a statement.

Since the acquisition of the Mumbai airport, the Adani Group has announced changes in the top management of AAHL. RK Jain, an industry veteran and CEO of MIAL, has been appointed as CEO of the group's airports business, while Behnad Zandi, who was earlier CEO for airports, will be CEO of non-aero business at AAHL. Captain BVJK Sharma, who was a director at Adani Ports and Special Economic Zone, will be CEO for Navi Mumbai International Airport; Prakash Tulsani, AAHL's president of operations, will take over as CEO of MIAL.

“With India’s passenger traffic is expected to grow fivefold, our nation needs 200 additional airports to handle 1 billion domestic and international passengers, most of whom will be using an airport, or a route connected to Mumbai,” Mahadevia says. That’s why the group isn’t going to shy away from scaling up the existing Mumbai airport, in addition to building the Navi Mumbai airport. “We look forward to creating around all Adani airports, including Mumbai, an ecosystem of aviation-linked businesses that will create multiple employment structures and thousands of job opportunities.”

For long, the Adani Group had specialised in building ecosystems around its core business, particularly in ports. The airport business is only getting started, and the opportunities are countless. Perhaps, much like its ports, the next decade could redefine India’s airport landscape forever. As for, the Adani juggernaut, it is showing no signs of stopping.

Post Your Comment