How the Amin family scions changed Alembic's fortunes

The gen-next of the Amin family has transformed the legacy business of Alembic Pharma into a generic formulations play and, in the process, put the company on an accelerated growth path

The skyline of Vadodara, Gujarat’s third largest city and the seat of the erstwhile princely state of Baroda, is transforming, slowly but surely. Spacious independent houses, neatly arranged in rows, have begun co-existing with clusters of residential towers springing up in different parts of the city, which is home to several affluent Gujarati entrepreneurs.

The Alembic Group, a business house promoted by the Amin family, is contributing to this evolution of the city’s landscape in no small measure. After all, the conglomerate —led by patriarch Chirayu Amin (cricket lovers will also know him as the interim chairman of the Indian Premier League in 2010, following the unceremonious exit of Lalit Modi as well as a former BCCI vice president)—owns over 100 acres of land in the city and is gradually developing portions of it into premium residential projects.

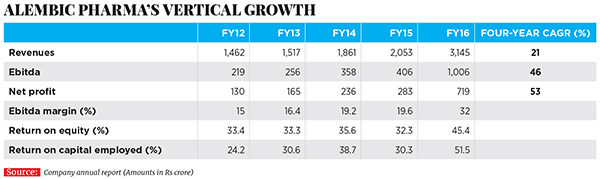

Though the group’s real estate venture has nothing to do with its flagship listed pharmaceuticals business, the towering vertical structures are metaphoric of the equally vertical growth exhibited by Alembic Pharmaceuticals Ltd —one of India’s fastest growing generic drug makers.

Amin, 69, and his forefathers laid the foundation of the 109-year-old Alembic’s modern-day pharma business by manufacturing and selling everything from tinctures and alcohol to vitamins, penicillin and then active pharma ingredients (API) over the years. And now the next generation—his sons Pranav, 41, and Shaunak, 38—are helping the company achieve its unrealised potential by transforming a commodity API business that “was going nowhere,” according to Pranav, into a domestic and international generic formulations play.

In doing so, the brothers have had to reimagine the way their family-owned legacy business functioned and think out-of-the-box to catch up with competitors who enjoyed a headstart in the international generics business.

Sitting in Alembic’s group headquarters in Vadodara, Amin senior, a cricket administrator by passion and former president of the Vadodara Cricket Association, tells Forbes India that around 12 years back, the company decided that it needed to “rejuvenate itself” and venture into international regulated markets, including the US and Europe. While the groundwork for this had already begun, it was up to Pranav and Shaunak to carry the agenda forward when they joined the family business.

“Pranav and Shaunak joined the business around 2003 after completing their education,” says Amin, who is Alembic Pharma’s chairman. “Ultimately, in 2008-2009, after they developed enough confidence and competency, I thought we should allow them to run the business as they had energy and new ideas; and we were not very happy with the performance of the professionals who were in charge at that time.”

Consequently, elder brother Pranav, who completed his MBA from Thunderbird, The American Graduate School of International Management, assumed charge of Alembic Pharma’s international business, while Shaunak, an economics grad from the University of Massachusetts, took over the reins of the domestic branded formulations business. Both are managing directors.

The pursuit of transforming Alembic Pharma from an API-driven business to a formulations-led drug maker was aided by the acquisition of Dabur India’s domestic cardiology, gastrointestinal and gynaecology brands in 2007. The transaction, which is the company’s only acquisition to date, took place at a consideration of around Rs 170 crore, which was just two-and-a-half times the acquired entity’s sales at that time. “The acquisition was very timely and at a decent price,” says RK Baheti, Alembic Pharma’s chief financial officer. “It gave us entry into segments where we weren’t present earlier, as well as key relationships with customers and vendors.”

Before that, Alembic Pharma’s domestic pharmaceuticals division was mostly making drugs for acute therapies such as anti-infective medicines; it had some popular brands in India, including antibiotics such as Azithral and Althrocin, and Glycodin cough syrup. But Pranav and Shaunak realised that acute therapies were not likely to be the future of the company, given rising competition and pricing pressure. The acquisition of the portfolio of drugs from Dabur paved the way for Alembic Pharma to enter the lifestyle and specialty drugs segment in the domestic market. The impact of this shift is evident in the numbers: In FY16, Alembic Pharma’s domestic branded formulations business grew by 13 percent year-on-year to Rs 1,104 crore (a third of Alembic Pharma’s overall revenues), and driven by the specialty segment revenues which were up by over 20 percent compared to a mere 4 percent in the acute segment. In FY12, specialty drugs constituted only 46 percent of sales from the domestic business. This has risen to 60 percent in FY16.

Growth also led to organisational restructuring. Till 2010, there was only one company listed on the bourses called Alembic Ltd, which housed all of the group’s assets, including commodity API, Indian and international formulations, as well as real estate. As the formulations-driven pharma business began to expand, the company’s promoters decided that it was time to create a structure that would ensure single-minded focus on growing that business without sacrificing management bandwidth or allowing external factors to intrude. Consequently, Alembic Pharma was carved out as a separate listed entity in 2010. Alembic Ltd continues to be a separate listed company with real estate development as its main business—this is led by Udit, Pranav and Shaunak’s youngest brother.

Alembic had made its first product for the US market (for another company) in FY2008, but it only set up its front-end marketing entity in the world’s largest market for generic drugs in 2015 and started selling drugs under the Alembic label. In the last one year, Alembic has launched 11 new drugs (in the US) under its own label. As of March 31, 2016, Alembic has filed 76 ANDAs with 47 approvals in place, indicating a robust pipeline of drugs to be launched over the next few years in that market. In FY16, Alembic’s international formulations business grew by 146 percent year-on-year to Rs 1,461.50 crore.

“Alembic Pharma’s export generics business is driven by strong traction in the US… on the back of consistent product launches, including limited competition products,” analysts Siddhanth Khandekar, Mitesh Shah and Nandan Kamat said in an ICICI Securities research report dated April 28, 2016. “Also, Alembic now has its own front-end team in the US, which gives the company better control over its product launches.” Going forward, Alembic plans to sell many of the drugs that it used to make for other companies on contract, under its own label.

Growing Alembic Pharma’s operations in India and abroad was one part of Pranav and Shaunak’s game plan; however, it had to be accompanied with crucial changes in the way Alembic Pharma did business. For instance, the brothers were conscious of the fact that their company was a late entrant in the US generics market, where it began operations around 10-12 years after other large Indian drug makers had entered the region. As a result, merely competing on price wouldn’t cut it for the company if it wanted to corner a sizeable share of the pie. So Alembic Pharma decided to make its supply chain highly competitive, and established confidence with prospective buyers regarding its ability to deliver medicines on time, every time. “We wanted to be a robust and nimble organisation in terms of our supply chain; have multiple product lines at our facilities that can be quickly ramped up as and when there is visibility of demand,” says Pranav. “A lot of companies have faced regulatory action from the US Food and Drug Administration over the last two-three years that has led to a restriction on import from their facilities. We wanted to capture that market left vacant by our competitors and cater to customers as a reliable supplier.”

Also, as Alembic moved from being a contract manufacturer that made to order to an independent supplier of drugs for retail shelves across global markets, the Amins sought to bring in an FMCG approach to their pharma business. They entrusted Vinod Kamat with the job of overseeing Alembic Pharma’s entire manufacturing operations. Kamat, an FMCG industry veteran, had spent 15 years at Marico looking after various elements of supply chain management, operations and other commercial functions. He came on board at Alembic Pharma in 2014 with an initial mandate to manage the supply chain, but was soon elevated to president-operations, which is essentially the head of manufacturing, supply chain, project management and procurement.

After Kamat came on board, the company moved away from monthly and quarterly production targets as an operational metric, and towards monitoring and adhering to lead time promised to buyers. The other FMCG industry practice that Kamat has brought to Alembic is self-regulation. In the FMCG industry, if anything goes wrong in the manufacturing process from a quality standpoint, it can have severe implications on the financials of the company, he says. It is probably a result of these efforts that Alembic Pharma’s manufacturing facilities in India [one each in Sikkim and Baddi (Himachal Pradesh) and four in Vadodara] have stayed away from any major adverse observations from the USFDA and maintained continuity of supply.

There have been other operational changes as well. For instance, in order to make the sales staff more efficient and ensure long-term growth in sales, Alembic Pharma also started incentivising its medical representatives based on their ability to sell products that were perceived to hold potential for the future, rather than purely doling out bonuses based on absolute sales.

With the necessary controls and operational strategies in place, Alembic Pharma is just getting started, the Amins reckon. In its 2015-16 annual report, the company has stated its intention to spend Rs 1,000 crore over the next 24-30 months to build new assets. These include two new facilities to make injectable drugs, including one for oncology; another new unit to make oncological drugs in the form of oral solids; and a facility for dermatological drugs, which is part of a joint venture with Orbicular Pharmaceutical Technologies, a Hyderabad-based research and development (R&D) company.

This is the single largest capex programme announced by the company ever, and is over and above the Rs 450 crore that it intends to spend in FY17 on R&D to build a pipeline of new products. To continue with a spate of new launches in regulated markets like the US, Alembic Pharma has significantly stepped up its R&D spending to an estimated 12-15 percent of its FY17 sales. To put things in perspective, 246 R&D projects were under implementation at Alembic Pharma in 2015-16, a staggering four-fold increase over the number of projects under execution in the preceding fiscal.

“The company is now at a new inflection point as it prepares to do away with one-off finite opportunities in the US,” the ICICI Securities report states. With the building blocks all in place, there is every chance that Vadodara’s skyline and Alembic’s growth chart will continue to evolve in tandem.

(This story appears in the 05 August, 2016 issue of Forbes India. To visit our Archives, click here.)